Regulatory Support for Anticoagulant Use

The regulatory environment in Italy is becoming increasingly supportive of anticoagulant therapies, including heparin. Recent guidelines issued by health authorities emphasize the importance of anticoagulation in the management of various medical conditions, thereby encouraging healthcare providers to utilize heparin more frequently. This regulatory support is likely to enhance the heparin market by facilitating easier access to heparin products and promoting their use in clinical practice. Furthermore, ongoing collaborations between regulatory bodies and pharmaceutical companies aim to streamline the approval process for new heparin formulations, which could lead to a broader range of options for healthcare providers and patients alike.

Rising Incidence of Cardiovascular Diseases

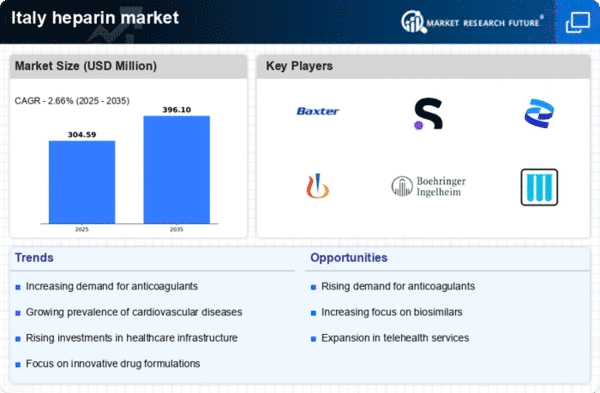

The heparin market in Italy is experiencing growth due to the increasing prevalence of cardiovascular diseases. According to health statistics, cardiovascular conditions account for a significant portion of mortality rates in Italy, prompting a higher demand for anticoagulants like heparin. This trend is likely to continue as the population ages, with projections indicating that by 2030, nearly 25% of the Italian population will be over 65 years old. Consequently, healthcare providers are increasingly prescribing heparin to manage and prevent thromboembolic events, thereby driving the heparin market. The Italian healthcare system's focus on improving cardiovascular health is expected to further bolster the demand for heparin, making it a critical component in treatment protocols.

Advancements in Pharmaceutical Manufacturing

Technological advancements in pharmaceutical manufacturing are significantly impacting the heparin market in Italy. Innovations in production processes, such as the development of more efficient extraction methods and purification techniques, have led to increased yields and reduced costs. This has allowed manufacturers to offer heparin at competitive prices, enhancing accessibility for healthcare providers. Furthermore, the Italian pharmaceutical industry is known for its stringent quality control measures, ensuring that heparin products meet high safety and efficacy standards. As a result, the heparin market is likely to benefit from improved product offerings and increased trust among healthcare professionals, which may lead to higher prescription rates.

Growing Awareness of Anticoagulant Therapies

There is a notable increase in awareness regarding anticoagulant therapies among both healthcare professionals and patients in Italy. Educational initiatives and campaigns aimed at informing the public about the risks of thromboembolic disorders have contributed to this trend. As patients become more informed about the benefits of heparin and its role in preventing serious health complications, the demand for heparin is expected to rise. Additionally, healthcare providers are increasingly recognizing the importance of anticoagulant therapy in managing various conditions, which is likely to enhance the heparin market. This growing awareness may lead to a more proactive approach in prescribing heparin, further driving its utilization in clinical settings.

Increase in Surgical Procedures Requiring Anticoagulation

The heparin market in Italy is also being driven by the rising number of surgical procedures that necessitate anticoagulation. As surgical techniques advance and become more prevalent, the need for effective anticoagulant management during and after surgery is paramount. Heparin is often the preferred choice due to its rapid onset of action and established safety profile. Data indicates that elective surgeries, particularly orthopedic and cardiovascular procedures, are on the rise in Italy, which is likely to increase the demand for heparin. This trend suggests that as surgical volumes grow, so too will the utilization of heparin, thereby positively impacting the heparin market.