Top Industry Leaders in the Gin Market

The Gin Market: A Comprehensive Analysis of the Competitive Landscape

The global gin market has experienced significant growth in recent years, driven by the resurgence of interest in craft spirits, premiumization trends, and evolving consumer tastes. As the market continues to expand, key players are strategically positioning themselves to capitalize on the growing demand for high-quality gin. This article provides a detailed examination of the competitive landscape, covering key players, strategies, market share factors, emerging companies, industry news, and a recent development in 2023.

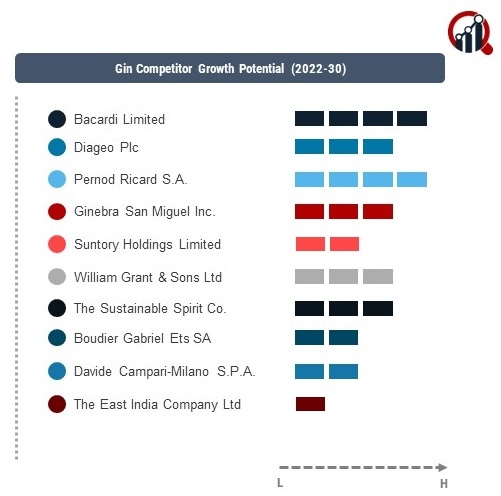

Key Players:

- Bacardi Limited (Bermuda)

- The East India Company Ltd (U.K.)

- William Grant & Sons Ltd (U.K.)

- Ginebra San Miguel Inc. (Philippines)

- The Poshmakers Ltd (U.K.)

- Forest Dry Gin (Belgium)

- West End Drinks Ltd (U.K.)

- Boudier Gabriel Ets SA (France)

- Diageo plc (U.K.)

- Pernod Ricard S.A. (France)

- Suntory Holdings Limited (Japan)

Strategies Adopted:

The gin market have implemented various strategies to maintain and enhance their market positions. These strategies include product innovation, marketing and branding initiatives, geographical expansion, and acquisitions. For instance, Diageo plc has focused on introducing new and innovative gin variants, leveraging its extensive distribution network and investing in strategic marketing campaigns to reinforce its brand presence. Acquisitions of boutique distilleries with unique offerings have also played a crucial role in expanding their gin portfolio.

Market Share Analysis:

The gin market involves evaluating multiple factors that impact competitive positioning. Key considerations include brand equity, product quality, pricing strategies, and the ability to adapt to changing consumer preferences. Companies that effectively address these factors are better positioned to capture and retain a significant share of the market. Additionally, factors such as the use of botanicals, flavor profiles, and sustainable practices contribute to market differentiation and influence consumer choices.

News & Emerging Companies:

The gin market has witnessed the emergence of new and innovative distilleries, reflecting the industry's adaptability and consumer interest in diverse flavor profiles. In 2023, emerging players like The Spirit Collective and Crafty Distillery entered the market with unique gin offerings, gaining attention for their emphasis on small-batch production, locally sourced botanicals, and distinctive flavor combinations. These newcomers contribute to the market's diversity, challenging established players and fostering innovation in the gin sector.

Industry Trends:

The gin market revolve around premiumization, sustainability, and the exploration of unique botanicals. Key players are investing in research and development to create premium gin expressions, exploring sustainable sourcing practices for botanicals, and adopting eco-friendly packaging solutions to align with evolving consumer values.

Current investment trends also highlight the importance of digital marketing and experiential strategies. Companies are leveraging online platforms and immersive experiences to connect with consumers and build brand loyalty. Additionally, investments in distillery tours, tasting experiences, and events contribute to creating a direct connection between consumers and the brand, enhancing the overall consumer experience.

Competitive Scenario:

The gin market is marked by robust rivalry among key players striving to establish themselves as leaders in this dynamic sector. Companies are strategically differentiating themselves through a combination of product innovation, marketing strategies, and a focus on premiumization. The market is shaped by factors such as brand loyalty, distribution networks, and the ability to cater to diverse consumer preferences, from classic London dry gin enthusiasts to those seeking unique and experimental flavor profiles.

Recent Development

The gin market was the introduction of a limited-edition, sustainably crafted gin by Pernod Ricard SA. This innovation marked a response to the growing consumer demand for sustainable and ethically produced spirits. The limited-edition gin was crafted using locally sourced botanicals and featured eco-friendly packaging, showcasing Pernod Ricard's commitment to environmental responsibility.

The strategic move highlighted the importance of aligning with consumer values and addressing sustainability concerns in the spirits industry. Pernod Ricard's development positioned the company as a leader in the sustainable gin segment, reinforcing its commitment to responsible practices. This move not only showcased the company's dedication to meeting evolving consumer expectations but also contributed to the broader industry trend towards more sustainable and environmentally conscious gin production.