Integration of Advanced Analytics

The integration of advanced analytics into the advertising software market is transforming how businesses approach marketing strategies in Germany. Companies are increasingly leveraging data analytics to gain insights into consumer behavior and preferences. This trend is evidenced by a reported 30% increase in the adoption of analytics tools among marketers in 2025. By utilizing these insights, businesses can tailor their advertising efforts more effectively, leading to improved engagement and conversion rates. The ability to analyze vast amounts of data allows for more informed decision-making, thereby enhancing the overall effectiveness of advertising campaigns. As a result, the demand for advertising software that incorporates advanced analytics capabilities is expected to rise significantly.

Shift Towards Omnichannel Marketing

The advertising software market is witnessing a shift towards omnichannel marketing strategies among businesses in Germany. This approach emphasizes the importance of delivering a seamless customer experience across various platforms, including social media, email, and websites. In 2025, it is estimated that 60% of marketers will adopt omnichannel strategies, highlighting the need for integrated advertising solutions. As companies strive to engage consumers through multiple touchpoints, the demand for advertising software that supports omnichannel campaigns is likely to grow. This trend not only enhances brand visibility but also fosters customer loyalty, as consumers appreciate cohesive messaging and interactions across different channels.

Emergence of Programmatic Advertising

The emergence of programmatic advertising is reshaping the landscape of the advertising software market in Germany. This automated approach to buying and selling ad space is gaining traction, with programmatic ad spending projected to account for over 50% of total digital ad expenditure by 2025. The efficiency and precision offered by programmatic advertising enable marketers to target specific audiences with tailored messages, thereby maximizing campaign effectiveness. As businesses increasingly recognize the benefits of automation in their advertising efforts, the demand for software solutions that facilitate programmatic buying is expected to rise. This shift not only streamlines the advertising process but also enhances the overall performance of marketing campaigns.

Rising Digital Advertising Expenditure

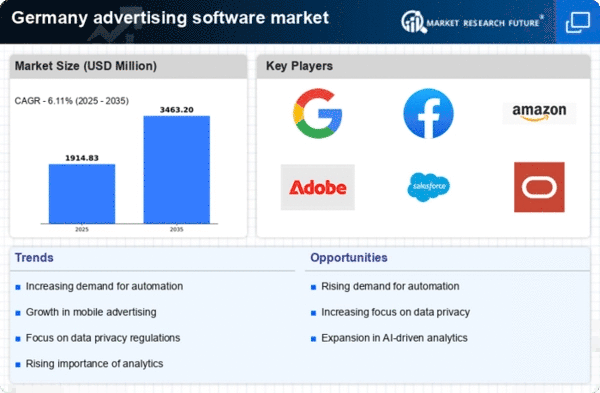

The advertising software market in Germany is experiencing a notable increase in digital advertising expenditure. In 2025, the digital ad spend is projected to reach approximately €10 billion, reflecting a growth rate of around 8% annually. This surge is driven by businesses recognizing the importance of online presence and the effectiveness of digital campaigns. As companies allocate more resources to digital channels, the demand for sophisticated advertising software solutions intensifies. These tools enable marketers to optimize their campaigns, track performance metrics, and enhance return on investment (ROI). Consequently, the advertising software market is likely to expand as organizations seek innovative solutions to navigate the evolving digital landscape.

Growing Importance of Mobile Advertising

The growing importance of mobile advertising is a key driver in the advertising software market in Germany. With over 80% of the population using smartphones, businesses are increasingly focusing on mobile-first strategies to reach their target audiences. In 2025, mobile advertising is projected to represent approximately 40% of total digital ad spending, underscoring its significance. As consumers spend more time on mobile devices, the demand for advertising software that optimizes campaigns for mobile platforms is likely to increase. This trend necessitates the development of innovative solutions that enhance user experience and engagement on mobile devices, ultimately driving growth in the advertising software market.