Rising Demand for Targeted Advertising

The advertising software market in Europe experiences a notable surge in demand for targeted advertising solutions. As businesses increasingly seek to optimize their marketing efforts, the ability to deliver personalized content to specific demographics becomes paramount. This trend is reflected in the market data, which indicates that targeted advertising accounts for approximately 60% of total advertising expenditures in Europe. Companies are leveraging advanced analytics and customer insights to refine their strategies, thereby enhancing engagement and conversion rates. The advertising software market is adapting to this shift by offering sophisticated tools that facilitate audience segmentation and real-time campaign adjustments. This growing emphasis on precision in advertising not only improves return on investment (ROI) but also fosters stronger customer relationships, ultimately driving growth within the sector.

Expansion of Digital Advertising Channels

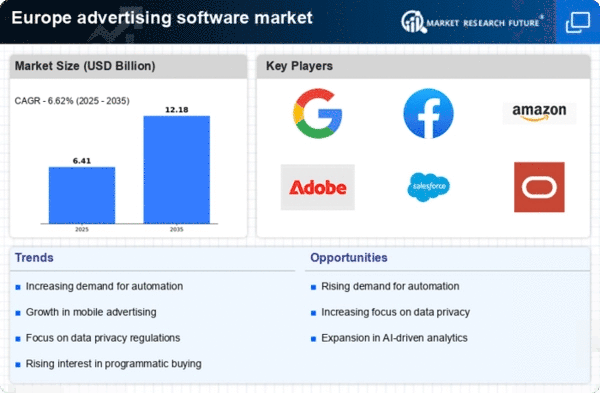

The advertising software market in Europe is significantly influenced by the rapid expansion of digital advertising channels. With the proliferation of social media platforms, mobile applications, and streaming services, businesses are increasingly allocating their budgets to digital formats. Recent statistics suggest that digital advertising spending in Europe is projected to reach €100 billion by 2026, representing a compound annual growth rate (CAGR) of 10%. This shift necessitates the development of innovative advertising software solutions that can seamlessly integrate across various platforms. The advertising software market is responding by enhancing capabilities for cross-channel marketing, enabling brands to maintain consistent messaging and optimize their campaigns across diverse digital landscapes. As a result, companies that invest in robust advertising software are likely to gain a competitive edge in this evolving marketplace.

Emphasis on Creative Content and Storytelling

The advertising software market in Europe is increasingly characterized by an emphasis on creative content and storytelling. As consumers become more discerning, brands are recognizing the need to engage audiences through compelling narratives rather than traditional advertising methods. This shift is reflected in the market, where creative campaigns are shown to generate up to 50% higher engagement rates compared to standard ads. The advertising software market is adapting by providing tools that enable marketers to create and distribute high-quality content across various channels. This focus on creativity not only enhances brand visibility but also fosters emotional connections with consumers. As a result, businesses that prioritize storytelling in their advertising strategies are likely to see improved customer loyalty and brand recognition, further driving growth within the sector.

Increased Investment in Programmatic Advertising

The advertising software market in Europe is witnessing a marked increase in investment in programmatic advertising. This automated approach to buying and selling ad space allows for more efficient and targeted campaigns. Recent reports indicate that programmatic advertising accounts for over 70% of digital ad spending in Europe, highlighting its growing dominance. As advertisers seek to maximize their reach and minimize costs, the demand for sophisticated advertising software that supports programmatic buying is on the rise. The advertising software market is responding by developing platforms that facilitate real-time bidding and audience targeting, thereby enhancing the effectiveness of advertising campaigns. This trend not only streamlines the advertising process but also enables brands to achieve higher engagement rates and improved ROI, making programmatic advertising a key focus for businesses in the region.

Growing Importance of Analytics and Performance Measurement

In the advertising software market in Europe, the growing importance of analytics and performance measurement is a critical driver. Businesses are increasingly recognizing the value of data in shaping their advertising strategies. The ability to track and analyze campaign performance allows companies to make informed decisions and allocate resources more effectively. Recent data indicates that 75% of marketers in Europe prioritize analytics tools to assess the effectiveness of their advertising efforts. This trend has led to a surge in demand for advertising software that offers comprehensive analytics features, enabling users to monitor key performance indicators (KPIs) in real-time. The advertising software market is evolving to meet this demand, providing solutions that not only facilitate data collection but also offer actionable insights for continuous improvement. Consequently, organizations that harness the power of analytics are better positioned to achieve their marketing objectives.