Government Initiatives and Funding

Government initiatives in Germany are playing a crucial role in shaping the 5g mm-wave-technology market. The German government has launched several programs aimed at promoting the deployment of 5g networks, including funding schemes that support research and development in mm-wave technologies. In 2025, the government allocated €1.5 billion to enhance digital infrastructure, which includes the expansion of 5g mm-wave capabilities. These initiatives not only encourage private sector investment but also foster collaboration between public and private entities. As a result, the 5g mm-wave-technology market is likely to see accelerated growth driven by these supportive policies and funding opportunities.

Rising Adoption of Smart Technologies

The increasing adoption of smart technologies across various sectors in Germany is significantly influencing the 5g mm-wave-technology market. Industries such as automotive, healthcare, and manufacturing are integrating smart solutions that rely on high-speed connectivity. For instance, the automotive sector is rapidly advancing towards connected and autonomous vehicles, which require robust 5g mm-wave networks for real-time data transmission. By 2025, it is estimated that over 50% of new vehicles in Germany will be equipped with 5g capabilities. This trend is likely to drive demand for mm-wave technology, as businesses seek to leverage its advantages for enhanced operational efficiency and innovation.

Increased Demand for High-Speed Internet

The demand for high-speed internet services in Germany is a significant driver for the 5g mm-wave-technology market. With the proliferation of smart devices and the Internet of Things (IoT), consumers and businesses alike are seeking faster and more reliable internet connections. According to recent data, approximately 75% of German households are expected to have access to 5g services by the end of 2025. This growing consumer base is pushing telecommunications providers to expand their mm-wave networks to meet the increasing demand for bandwidth-intensive applications such as streaming, gaming, and telecommuting. As a result, the 5g mm-wave-technology market is likely to benefit from this heightened demand, prompting further investments in infrastructure and technology.

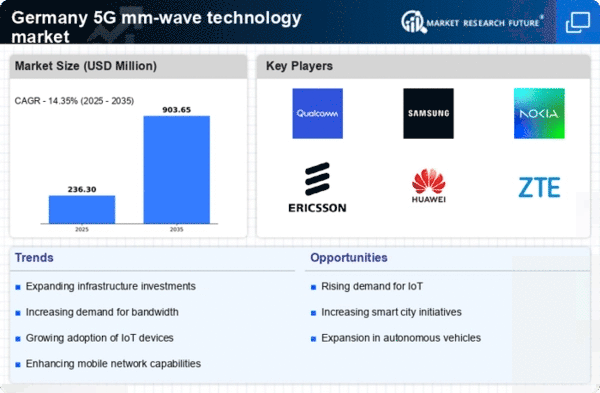

Competitive Landscape and Market Dynamics

The competitive landscape of the 5g mm-wave-technology market in Germany is characterized by the presence of several key players striving to capture market share. Major telecommunications companies are investing heavily in mm-wave technology to differentiate their services and enhance customer experience. The market dynamics are influenced by factors such as pricing strategies, service offerings, and technological innovations. In 2025, it is projected that the market will witness a growth rate of approximately 20% annually, driven by fierce competition among providers. This competitive environment is likely to spur advancements in mm-wave technology, further propelling the growth of the market.

Technological Advancements in Telecommunications

The 5g mm-wave-technology market in Germany is experiencing a surge due to rapid technological advancements in telecommunications. Innovations in antenna design and signal processing are enhancing the efficiency and performance of mm-wave systems. As a result, network operators are increasingly investing in infrastructure upgrades to support higher data rates and lower latency. The German telecommunications sector has seen investments exceeding €10 billion in 2025 alone, aimed at expanding mm-wave coverage. This investment is likely to facilitate the deployment of advanced applications such as augmented reality and smart city solutions, which require high-speed connectivity. Consequently, the growth of the 5g mm-wave-technology market is closely tied to these technological improvements, which are expected to drive demand for enhanced network capabilities.