Top Industry Leaders in the Generative AI in Fintech Market

Competitive Landscape of Generative AI in Fintech Market

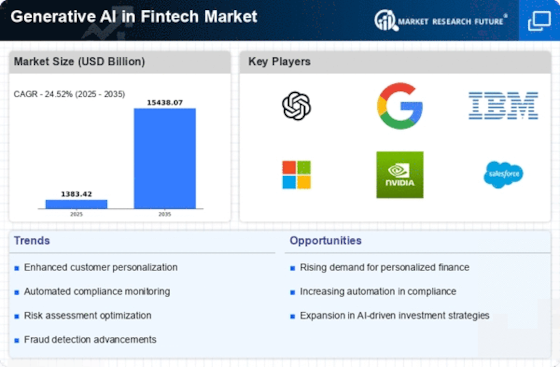

The financial technology (Fintech) landscape is experiencing a paradigm shift, driven by the powerful capabilities of Generative AI (GAI). With its ability to create synthetic data, personalize experiences, and automate tasks, GAI is revolutionizing every facet of financial services, from fraud detection to wealth management. This dynamic market boasts a diverse range of players, each vying for a piece of the pie. Delving into the competitive landscape requires examining key players, their strategies, and the factors impacting market share.

Key Players:

-

Adobe Inc.

-

Genie AI Ltd.

-

Google LLC

-

IBM Corporation

-

Microsoft Corporation

-

MOSTLY AI Inc.

-

Open AI

-

Palantir

-

Synthesis AI

-

Trovata AI

-

Veesual AI

Factors Influencing Market Share:

-

Technology Focus: Companies demonstrating consistent advancements in GAI algorithms, data handling capabilities, and user-friendly interfaces will attract more clients.

-

Industry Expertise: Understanding the specific challenges and nuances of financial services is crucial for developing practical and efficient GAI solutions. Players with strong financial domain knowledge hold an edge.

-

Scalability and Security: Financial institutions prioritize platforms that can handle large volumes of data securely and ensure regulatory compliance. Robust infrastructure and comprehensive security protocols are essential for competitive advantage.

-

Partnerships and Collaborations: Strategic partnerships with leading financial institutions, technology providers, and academic institutions can accelerate GAI adoption and expand market reach.

-

Customer Focus: Demonstrating the tangible value proposition of GAI solutions through clear ROI calculations and personalized customer support will drive market share growth.

Emerging Companies and Investment Trends:

The GAI space is witnessing a surge in new ventures, each addressing specific niches within the Fintech market. Notable examples include:

-

Risk Management: Socure and BehavioSec use GAI to analyze behavioral patterns and detect fraudulent transactions in real-time.

-

Wealth Management: Jemstone and Altruist leverage GAI to personalize investment advice and automate portfolio management for individual clients.

-

Insurance: Lemonade and At-Bay have deployed GAI for claims processing, fraud detection, and personalized insurance pricing.

Venture capital and private equity firms are pouring funds into GAI startups, recognizing the immense potential of this technology in redefining the financial landscape. Investment trends focus on companies targeting high-impact areas like risk management, regulatory compliance, and financial inclusion.

Latest Industry News:

Jan 25, 2024: The banking giant has signed a multi-year deal with GAI specialist Kensho to utilize its advanced algorithms for credit risk assessment and portfolio optimization. This collaboration aims to improve loan decision-making and enhance risk management capabilities.

Jan 20, 2024: BofA unveiled "Erica AI," a virtual assistant powered by GAI that provides personalized investment advice and portfolio management assistance to its wealth management clients. This move signifies a growing trend of AI adoption in personalized financial services.

Jan 18, 2024: Lloyd's of London, the world's oldest insurance market, has received regulatory approval for its first insurance product underwritten solely by GAI algorithms. This breakthrough marks a significant step towards AI-driven underwriting in the insurance industry.

Jan 10, 2024: The fraud prevention startup, utilizing GAI for real-time transaction analysis, has secured $50 million in new funding to expand its product offerings and global reach. This investment reflects the growing market confidence in GAI solutions for financial security.