- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

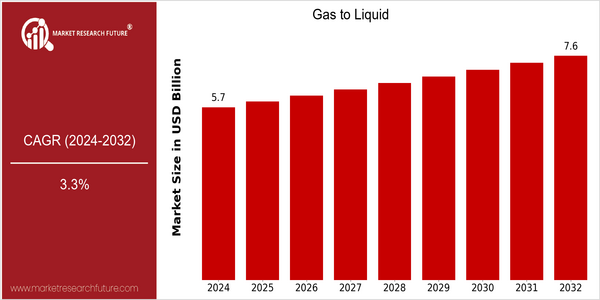

| Year | Value |

|---|---|

| 2024 | USD 5.65 Billion |

| 2032 | USD 7.58 Billion |

| CAGR (2024-2032) | 3.3 % |

Note – Market size depicts the revenue generated over the financial year

The Gas to Liquid (GTL) market is poised for steady growth, with a current market size of USD 5.65 billion in 2024, projected to reach USD 7.58 billion by 2032, reflecting a compound annual growth rate (CAGR) of 3.3% over the forecast period. This growth trajectory indicates a robust demand for GTL technologies, driven by the increasing need for cleaner fuels and the rising adoption of natural gas as a feedstock in various applications. As industries and governments worldwide prioritize sustainability, the shift towards GTL processes is becoming more pronounced, aligning with global energy transition goals. Several factors are propelling this market expansion, including advancements in GTL technology that enhance efficiency and reduce costs, making it more competitive against traditional refining methods. Additionally, strategic initiatives by key players such as Shell, Sasol, and Chevron, which include partnerships and investments in innovative GTL projects, are further stimulating market growth. For instance, Shell's ongoing investments in its GTL facilities in Qatar exemplify the commitment to expanding production capabilities and meeting the growing demand for high-quality synthetic fuels. As the market evolves, these technological advancements and strategic collaborations will be critical in shaping the future landscape of the GTL industry.

Regional Market Size

Regional Deep Dive

The Gas to Liquid (GTL) market is experiencing significant growth across various regions, driven by the increasing demand for cleaner fuels and advancements in technology. In North America, the abundance of natural gas resources and supportive regulatory frameworks are propelling the market forward. Europe is focusing on reducing carbon emissions, leading to investments in GTL technologies. The Asia-Pacific region is witnessing rapid industrialization, which is boosting the demand for synthetic fuels. Meanwhile, the Middle East and Africa are leveraging their vast natural gas reserves to develop GTL projects, while Latin America is exploring GTL as a means to diversify its energy portfolio. Each region presents unique opportunities and challenges that shape the GTL landscape.

Europe

- The European Union's Green Deal aims to make Europe climate-neutral by 2050, which is fostering investments in GTL as a cleaner alternative to traditional fuels.

- Companies like Velocys are developing innovative GTL technologies in the UK, supported by government grants aimed at reducing carbon emissions.

Asia Pacific

- Countries like China and India are ramping up their GTL capabilities to meet the growing energy demands of their rapidly industrializing economies.

- The Australian government is promoting GTL projects through funding and partnerships, recognizing the potential of GTL in reducing reliance on imported fuels.

Latin America

- Brazil is exploring GTL as part of its energy diversification strategy, with initiatives supported by the government to promote cleaner fuel alternatives.

- The region's unique biodiversity and environmental concerns are influencing regulatory frameworks that encourage the adoption of GTL technologies.

North America

- The U.S. has seen a surge in GTL projects, with companies like Shell and Chevron investing heavily in new facilities, driven by the country's vast shale gas reserves.

- Recent regulatory changes, such as the U.S. Environmental Protection Agency's (EPA) initiatives to promote cleaner fuels, are encouraging the adoption of GTL technologies.

Middle East And Africa

- Qatar and Saudi Arabia are leading the way in GTL development, with major projects like Qatar's Pearl GTL facility showcasing the region's capabilities.

- The region's focus on diversifying its economy away from oil dependency is driving investments in GTL technologies and infrastructure.

Did You Know?

“Did you know that the world's largest GTL plant, Pearl GTL, located in Qatar, can produce up to 140,000 barrels of synthetic crude oil per day?” — Qatar Petroleum

Segmental Market Size

The Gas to Liquid (GTL) market segment plays a crucial role in the broader energy landscape, currently experiencing stable growth driven by increasing demand for cleaner fuels. Key factors propelling this segment include stringent regulatory policies aimed at reducing carbon emissions and the rising consumer preference for sustainable energy solutions. Additionally, advancements in GTL technologies enhance the efficiency and economic viability of converting natural gas into liquid fuels, further stimulating demand. Currently, the GTL market is in a scaled deployment stage, with notable projects such as Shell's Pearl GTL in Qatar and the Oryx GTL facility, showcasing successful implementation. Primary applications include transportation fuels, lubricants, and chemical feedstocks, with companies like Sasol and Chevron leading in production. Macro trends such as global sustainability initiatives and government mandates for cleaner energy sources are accelerating growth in this segment. Technologies like Fischer-Tropsch synthesis and innovative catalysts are shaping the evolution of GTL processes, making them more efficient and environmentally friendly.

Future Outlook

The Gas to Liquid (GTL) market is poised for steady growth from 2024 to 2032, with a projected market value increase from $5.65 billion to $7.58 billion, reflecting a compound annual growth rate (CAGR) of 3.3%. This growth trajectory is underpinned by the increasing demand for cleaner fuels and the ongoing transition towards sustainable energy solutions. As countries implement stricter environmental regulations and policies aimed at reducing carbon emissions, the adoption of GTL technology is expected to rise, enhancing its penetration in various sectors, including transportation and industrial applications. By 2032, GTL products are anticipated to capture a more significant share of the global fuel market, driven by their lower environmental impact compared to traditional fossil fuels. Key technological advancements, such as improvements in catalytic processes and the development of more efficient gas conversion technologies, are likely to further bolster the GTL market. Additionally, the integration of GTL with renewable energy sources presents a promising avenue for innovation, potentially leading to hybrid systems that optimize resource utilization. Emerging trends, including the increasing investment in infrastructure for GTL facilities and the growing interest from major oil and gas companies in diversifying their portfolios, will also play a crucial role in shaping the market landscape. As the industry evolves, stakeholders are encouraged to stay attuned to these developments to capitalize on the opportunities presented by the expanding GTL market.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 14.79 Billion |

| Market Size Value In 2023 | USD 15.70 Billion |

| Growth Rate | 6.11% (2023-2031)Base Year2022Forecast Period2023-2031Historical Data2020 & 2021Forecast UnitsValue (USD Billion)Report CoverageRevenue Forecast, Competitive Landscape, Growth Factors, and TrendsSegments CoveredVoltage, Output Power, End-user, and RegionGeographies CoveredNorth America, Europe, Asia Pacific, and Rest of the WorldCountries CoveredThe U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and BrazilKey Companies ProfiledGeneral Electric (U.S.), Siemens (Germany), ABB (Switzerland), Robert Bosch GmbH (Germany), Emerson Electric Co. (US), Hitachi, Ltd. (Japan), Johnson Electric Holdings Limited (China), Rockwell Automation, Inc. (US), and others.Key Market OpportunitiesIncreasing use of Natural GasKey Market DynamicsRising Demand for Energy along with Demand for Hydrocarbon Products to Augment Growth in the Market |

Gas to liquid Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.