Increased Crime Rates

The Forensic Swab Market is significantly influenced by the rising crime rates observed in various regions. As criminal activities escalate, law enforcement agencies are compelled to enhance their investigative capabilities. This has led to a heightened demand for forensic swabs, which are essential for collecting biological evidence at crime scenes. According to recent statistics, certain areas have reported a surge in violent crimes, necessitating the use of advanced forensic techniques. Consequently, the market for forensic swabs is expected to expand as police departments and forensic laboratories seek to improve their evidence collection methods. This trend indicates a direct correlation between crime rates and the growth of the Forensic Swab Market, as agencies strive to ensure justice through effective forensic analysis.

Public Awareness and Funding

The Forensic Swab Market is benefiting from increased public awareness regarding the importance of forensic science in criminal justice. As communities become more informed about the role of forensic evidence in solving crimes, there is a growing demand for improved forensic services. This heightened awareness often translates into increased funding for law enforcement agencies and forensic laboratories. Governments and private organizations are recognizing the necessity of investing in advanced forensic technologies, including high-quality swabs. This influx of funding is likely to enhance the capabilities of forensic teams, leading to more efficient crime scene investigations. As a result, the Forensic Swab Market is poised for growth, driven by both public interest and financial support for forensic advancements.

Regulatory Standards and Compliance

The Forensic Swab Market is also shaped by stringent regulatory standards and compliance requirements. Various jurisdictions are implementing guidelines that mandate the use of specific types of forensic swabs to ensure the integrity of evidence collection. These regulations are designed to uphold the quality and reliability of forensic investigations, thereby influencing the purchasing decisions of law enforcement agencies. As compliance becomes increasingly critical, manufacturers of forensic swabs are compelled to innovate and meet these standards. This trend is likely to drive the market forward, as agencies seek to procure swabs that adhere to regulatory requirements. Consequently, the Forensic Swab Market is expected to witness growth as compliance with these standards becomes a priority for forensic professionals.

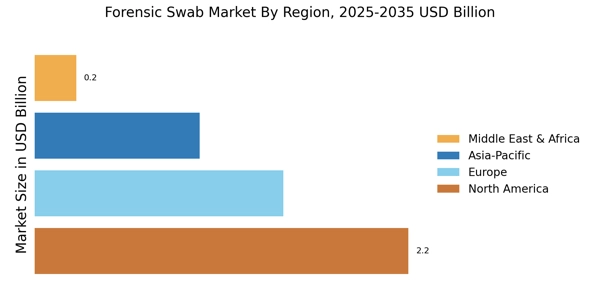

Emerging Markets and Global Expansion

The Forensic Swab Market is witnessing growth opportunities in emerging markets, where the demand for forensic services is on the rise. As countries develop their law enforcement capabilities, there is an increasing recognition of the importance of forensic science in criminal investigations. This trend is particularly evident in regions where crime rates are escalating, prompting governments to invest in forensic technologies. The expansion of forensic laboratories and training programs is likely to enhance the overall effectiveness of crime scene investigations. Additionally, as international collaborations in forensic science increase, the market for forensic swabs is expected to grow. This The Forensic Swab Industry, as new players enter the market and existing companies seek to establish a presence in these developing regions.

Technological Advancements in Forensic Swab Market

The Forensic Swab Market is experiencing a notable transformation due to rapid technological advancements. Innovations in materials and design are enhancing the efficacy of swabs used in forensic investigations. For instance, the introduction of specialized swabs that can capture minute biological samples is becoming increasingly prevalent. This is particularly relevant as the demand for accurate and reliable forensic evidence continues to rise. Furthermore, advancements in automation and robotics are streamlining the collection and analysis processes, thereby increasing efficiency. The market is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years, driven by these technological improvements. As a result, law enforcement agencies are likely to invest more in advanced forensic tools, further propelling the growth of the Forensic Swab Market.