Market Analysis

In-depth Analysis of Food Texturants Market Industry Landscape

Food Texturants Market is a complex confluence of factors, which shape its dynamics. As a vital part of the food sector, texturants are crucial in adding to the taste and feel of food products by influencing their texture, mouthfeel and overall quality. One major factor driving this market is the rising consumer demand for diverse and appealing food textures. In addition to being more concerned about flavors within foods, consumers are also interested in how they feel in the mouth. This has led to increased application of texturants in different types of foods such as; bakery goods, beverages, confectioneries and processed foods.

Economic aspects also have strong implications on Food Texturants Market. The cost effectiveness and flexibility aspect make texturants attractive to manufacturers who want to optimize production processes. Additionally, due to changing lifestyles and busy schedules, there is an increasing demand on convenience foods requiring stability shelf life that usually require inclusion of texturant additives among other components. The low-cost implications associated with these substances make them important ingredients for various processed and convenience foods.

Consumer health trends and dietary choices form critical drivers of market dynamics. Growing awareness about healthiness has led to increased demand for clean label natural food ingredients. This has seen manufacturers come up with texturing agents from natural sources such as extracts from seaweed or pectin as well as starches among others that would meet the increasing need for healthier options through highly natural foodstuffs. Changing consumer tastes have influenced innovation in the industry producing food fortifiers especially those that do not contain additives.

However, Food Texturants Market dynamics face several challenges. Regulatory scrutiny coupled with stringent requirements around food safety poses a challenge for manufacturing companies. Consumers’ growing consciousness regarding what constitutes their meals is emphasizing transparency and accountability too. Maintaining the right texture in food products that meet these strict regulations is a delicate balance and requires constant research and development.

Technological advancement and innovation are crucial determinants of market dynamics in Food Texturants Market. New processing techniques as well as identification of new texturizing agents have resulted to more types of texturants available to the industry. Advanced technology allows for customization of texture attributes, hence enabling producers to create unique and differentiated products. As such, it is notable that this is an innovative driven field therefore there is stiff competition among the market players who invest heavily on research and development so as to be on top in this fast-changing sector.

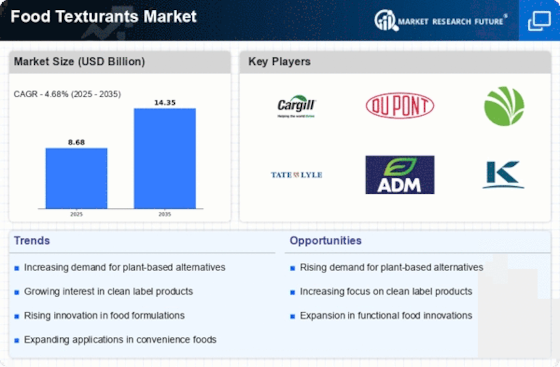

A consolidation trend can be seen in the food texturants market dynamics. This trend includes mergers, acquisitions, partnerships and collaborations by major players which they use to consolidate their positions, diversify their product offerings and take advantage of synergies. In general terms, bigger companies tend to dominate with many smaller ones focusing on niche markets or regional areas because of the ongoing consolidation process within the industry.

Leave a Comment