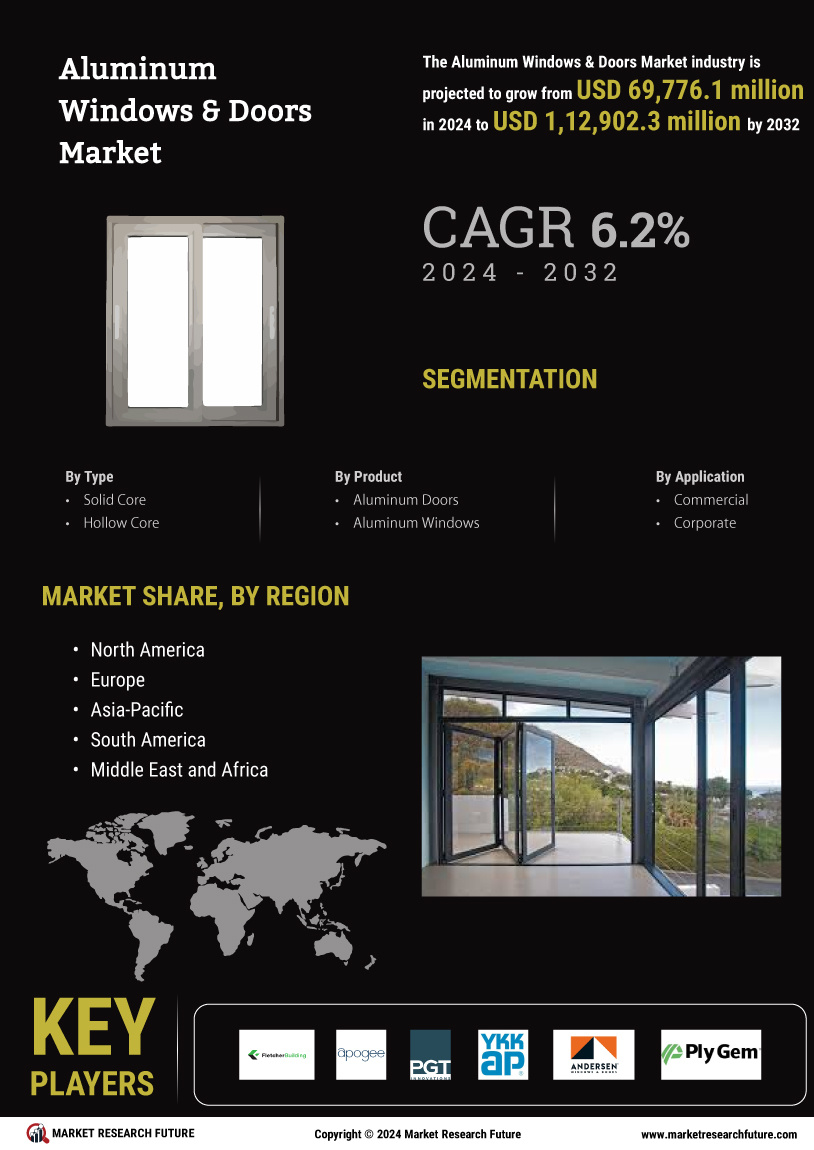

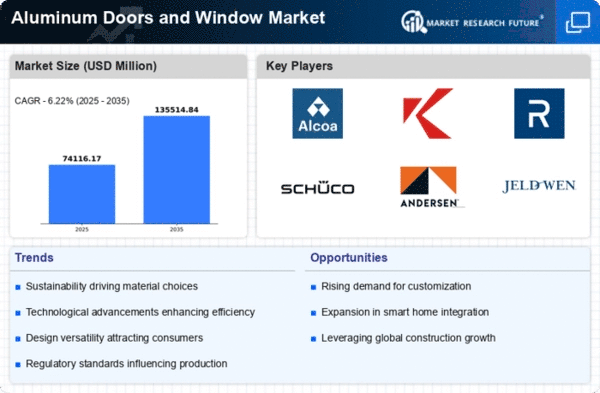

Market Growth Projections

The Global Aluminum Windows and Doors Market Industry is poised for substantial growth, with projections indicating a market value of 69.8 USD Billion in 2024 and an anticipated increase to 135.2 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 6.2% from 2025 to 2035, driven by various factors including urbanization, technological advancements, and increasing consumer demand for energy-efficient solutions. The market's expansion reflects broader trends in construction and building materials, highlighting the importance of aluminum windows and doors in modern architecture.

Rising Demand for Energy Efficiency

The Global Aluminum Windows and Doors Market Industry experiences a notable increase in demand driven by the growing emphasis on energy efficiency in residential and commercial buildings. As energy costs rise, consumers and builders alike seek solutions that reduce energy consumption. Aluminum windows and doors, known for their thermal performance and durability, are increasingly favored. This trend is reflected in the projected market value of 69.8 USD Billion in 2024, as stakeholders prioritize energy-efficient solutions. Furthermore, the shift towards sustainable building practices is likely to bolster this demand, making energy efficiency a pivotal driver in the industry.

Government Regulations and Standards

Government regulations and standards play a crucial role in shaping the Global Aluminum Windows and Doors Market Industry. Stricter building codes and energy efficiency standards are being implemented worldwide, compelling manufacturers to innovate and comply with these requirements. This regulatory landscape encourages the adoption of aluminum windows and doors, which often meet or exceed these standards due to their inherent properties. Compliance not only enhances product credibility but also opens up new market opportunities. As governments increasingly prioritize sustainability, the demand for compliant aluminum solutions is expected to rise, further driving market growth.

Technological Advancements in Manufacturing

Technological advancements in manufacturing processes are reshaping the Global Aluminum Windows and Doors Market Industry. Innovations such as automated production lines and advanced coating techniques enhance product quality and reduce costs. These improvements not only streamline production but also enable manufacturers to offer a wider range of customizable options to meet diverse consumer preferences. As a result, the industry is likely to witness increased competition and improved product offerings. The integration of smart technologies into aluminum windows and doors further enhances their appeal, aligning with modern consumer expectations for functionality and design.

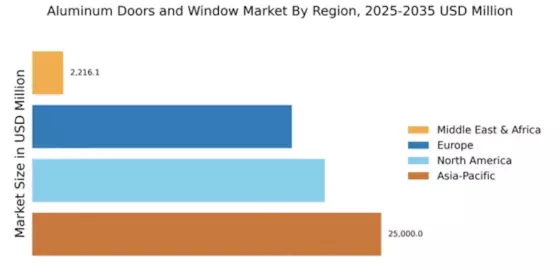

Urbanization and Infrastructure Development

Urbanization continues to accelerate globally, leading to increased construction activities and infrastructure development. This trend significantly influences the Global Aluminum Windows and Doors Market Industry, as urban areas expand and require modern building solutions. The demand for aluminum windows and doors is particularly pronounced in emerging economies, where urban growth is rapid. As cities evolve, the need for aesthetically pleasing, durable, and low-maintenance building materials becomes critical. This urban expansion is expected to contribute to the market's growth, with projections indicating a market size of 135.2 USD Billion by 2035, reflecting the ongoing infrastructure investments.

Consumer Preference for Aesthetics and Durability

Consumer preferences are shifting towards products that combine aesthetics with durability, significantly impacting the Global Aluminum Windows and Doors Market Industry. Homeowners and builders are increasingly seeking aluminum windows and doors that offer modern designs while ensuring longevity and low maintenance. This trend is particularly evident in high-end residential projects and commercial buildings, where visual appeal is paramount. As a result, manufacturers are focusing on design innovation and customization options to cater to these evolving preferences. This shift is likely to contribute to the market's projected growth, with a compound annual growth rate of 6.2% anticipated from 2025 to 2035.