Top Industry Leaders in the Food Color Market

Strategies Adopted by Food Color Key Players

The food color market has witnessed substantial growth due to increasing consumer demand for visually appealing and vibrant food products. This analysis provides insights into the key players, strategies adopted, market share determinants, emerging companies, industry trends, and recent developments in 2023.

Key Players:

The food color market is characterized by the presence of key players with a substantial market share and emerging companies aiming to capitalize on the growing demand for diverse and natural food colors. Key players include:

ADM (US)

Lycored (Israel)

International Flavors & Fragrances Inc (US)

DDW (US)

Döhler Group (Germany)

Florio Colori (Italy)

Sensient Technologies Corporation (US)

DSM (Netherlands)

Naturex (France)

Kalsec Inc (US)

Key players in the food color market deploy various strategies to maintain and enhance their competitive positions:

- Focus on Natural and Clean-Label Products: With the increasing consumer preference for natural and clean-label products, companies are prioritizing the development and marketing of food colors derived from natural sources.

- Innovation in Application Technologies: Companies are investing in research and development to enhance the stability, solubility, and versatility of food colors, enabling their application in a wide range of food and beverage products.

- Strategic Partnerships and Collaborations: Collaboration with food and beverage manufacturers, research institutions, and other industry players is a common strategy to enhance product development, distribution, and market presence.

- Expansion of Product Portfolios: To meet the evolving demands of the market, companies are expanding their product portfolios to offer a diverse range of food colors suitable for different applications and consumer preferences.

Market Share Analysis:

Several factors influence market share dynamics in the food color market:

- Regulatory Compliance: Companies ensuring compliance with food safety regulations and certifications gain consumer trust, contributing to a larger market share.

- Research and Development Capabilities: The ability to invest in cutting-edge research and development capabilities to create innovative and sustainable food color solutions is a significant determinant of market share.

- Global Presence and Distribution Networks: Companies with a robust global presence and efficient distribution networks can meet the demands of diverse markets, contributing to increased market share.

- Consumer Perception and Preferences: Understanding and adapting to changing consumer preferences, especially regarding natural and clean-label products, is crucial for gaining and retaining market share.

News & Emerging Companies:

Recent developments and emerging companies in the food color market indicate ongoing trends and potential shifts:

- Growing Popularity of Plant-Based Colors: Emerging companies are focusing on developing plant-based food colors to meet the rising demand for sustainable and natural alternatives.

- Expansion into New Application Areas:Companies are exploring and entering new application areas such as plant-based meat alternatives, dairy alternatives, and confectionery, broadening their product offerings.

Industry Trends:

Investment trends within the food color market reflect a commitment to sustainability, innovation, and addressing evolving consumer needs:

- Investment in Sustainable Sourcing: Companies are increasingly investing in sustainable sourcing practices for raw materials used in food color production, aligning with consumer expectations for environmentally responsible products.

- Acquisitions and Mergers:Strategic acquisitions and mergers are prevalent in the industry, enabling companies to enhance their capabilities, expand their product portfolios, and strengthen market positions.

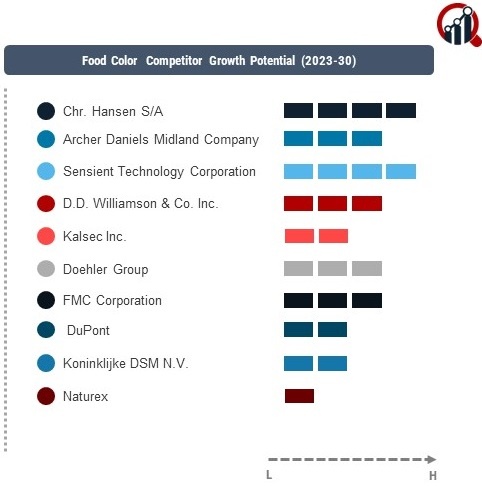

Competitive Scenario:

The food color market remains highly competitive, with key players leveraging their expertise in natural color solutions, innovation, and global reach. Emerging companies, often focusing on niche segments and sustainable practices, contribute to the dynamic competitive landscape.

Recent Development

A notable development in 2023 is the increased investment by key players in sustainable sourcing practices. Companies are taking significant steps to ensure that the raw materials used in their food color production adhere to stringent sustainability standards, reflecting a broader industry commitment to environmental responsibility. This development aligns with the growing consumer preference for ethically sourced and sustainable food color solutions.