Growth in Oil and Gas Applications

The Fluorosurfactants Market is benefiting from the increasing utilization of fluorosurfactants in oil and gas applications. These substances are employed to enhance the efficiency of drilling fluids and improve the recovery rates of oil and gas. As energy demands continue to rise, the oil and gas sector is seeking innovative solutions to optimize extraction processes. Fluorosurfactants play a critical role in reducing interfacial tension, which can lead to improved performance in challenging environments. Market analysis suggests that the oil and gas segment is expected to witness a growth rate of around 4% in the coming years, further solidifying the position of fluorosurfactants as essential components in this industry.

Emerging Applications in Electronics

The Fluorosurfactants Market is witnessing emerging applications in the electronics sector, where these substances are utilized in the manufacturing of electronic components. Fluorosurfactants are known for their ability to reduce surface tension, which is crucial in processes such as soldering and coating of electronic devices. As the electronics industry continues to evolve, the demand for high-performance materials is increasing. Reports suggest that the electronics segment is expected to grow at a compound annual growth rate of around 5% over the next few years. This growth presents a significant opportunity for the Fluorosurfactants Market, as manufacturers adapt to the needs of this dynamic sector.

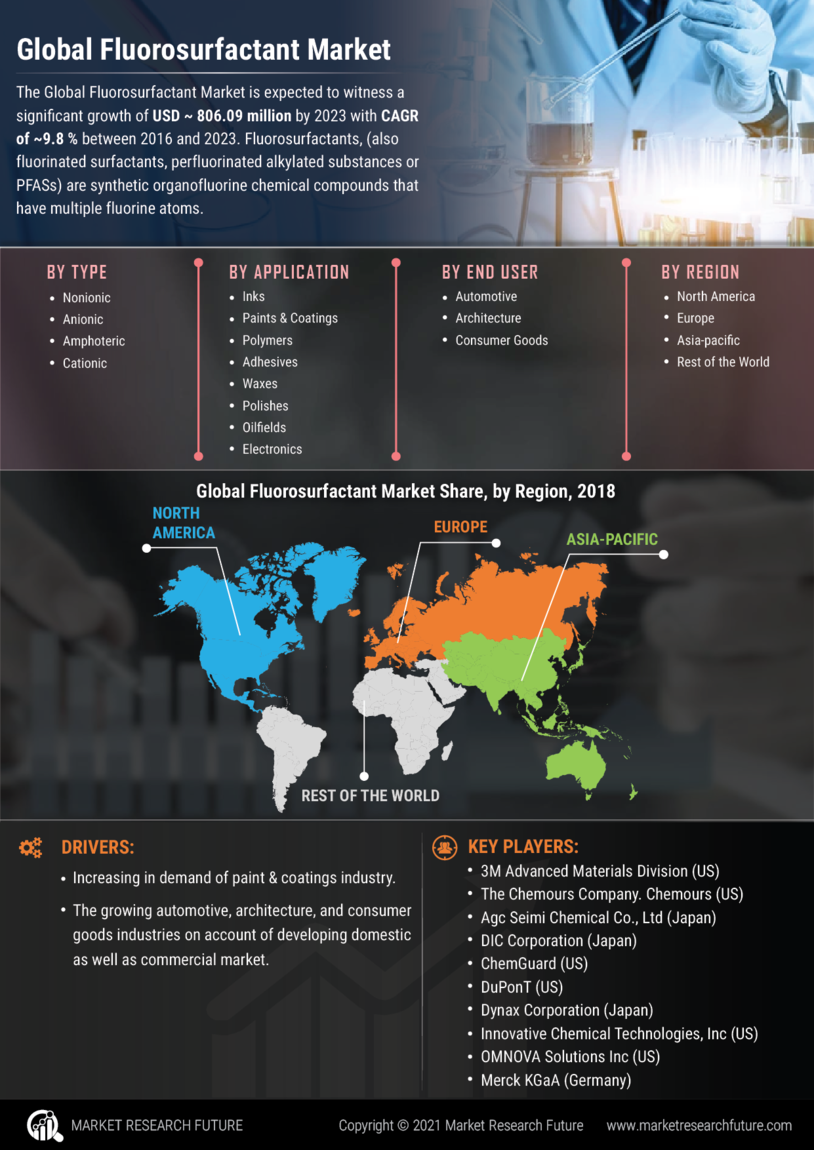

Rising Demand in Coatings and Paints

The Fluorosurfactants Market is experiencing a notable increase in demand from the coatings and paints sector. Fluorosurfactants are utilized to enhance the wetting and spreading properties of coatings, which is crucial for achieving high-quality finishes. As the construction and automotive industries expand, the need for advanced coatings that offer durability and resistance to environmental factors is becoming more pronounced. Reports indicate that the coatings segment is projected to grow at a compound annual growth rate of approximately 5% over the next few years. This growth is likely to drive the demand for fluorosurfactants, as manufacturers seek to improve product performance and meet stringent regulatory standards. Consequently, the Fluorosurfactants Market is poised to benefit from this upward trend in the coatings sector.

Advancements in Personal Care Products

The Fluorosurfactants Market is also experiencing growth due to advancements in personal care products. Fluorosurfactants are increasingly being incorporated into formulations for cosmetics and skincare items, where they enhance product performance by improving texture and application. The demand for high-performance personal care products is on the rise, driven by consumer preferences for premium formulations. Market data indicates that the personal care segment is projected to grow at a rate of approximately 6% annually, reflecting a shift towards innovative and effective products. This trend is likely to bolster the Fluorosurfactants Market as manufacturers seek to differentiate their offerings in a competitive landscape.

Increased Focus on Environmental Regulations

The Fluorosurfactants Market is significantly influenced by the tightening of environmental regulations across various regions. Governments are increasingly implementing stringent guidelines to limit the use of harmful substances in industrial applications. Fluorosurfactants, known for their unique properties, are being scrutinized for their environmental impact. However, advancements in the development of eco-friendly fluorosurfactants are emerging as a response to these regulations. The market is witnessing a shift towards sustainable alternatives that maintain performance while adhering to environmental standards. This transition is expected to create new opportunities for manufacturers in the Fluorosurfactants Market, as they innovate to meet regulatory demands while satisfying customer needs for effective and safe products.