Market Share

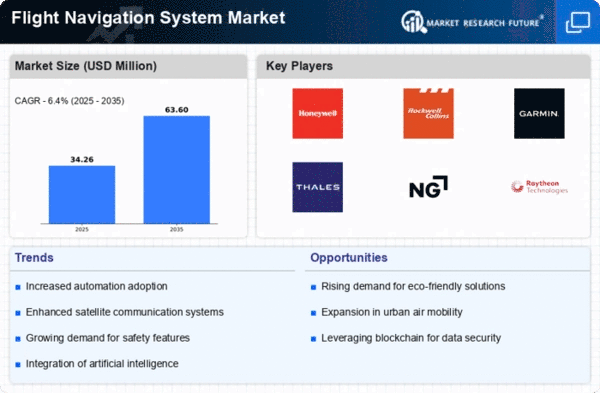

Flight Navigation System Market Share Analysis

Flight Navigation Systems are essential to the aviation industry, guiding and controlling planes. Companies use market share positioning methods to identify their strengths in this important sector. One important method is mechanical separation, where companies invest in cutting-edge navigation systems with high precision, quality, and utility. Satellite-based navigation systems, upgraded GPS, and computerized flight control systems help companies stand out and attract airlines and airplane manufacturers searching for cutting-edge navigation.

Cost authority is another important Flight Navigation System market share positioning approach. Organizations may try to become financially savvy navigation service providers, delivering competitive pricing without compromising performance or security. To provide a steady stock of parts at optimal prices, cost initiative requires efficient production processes, economies of scale, and key organizations with providers. Economical airlines and administrators seeking reliable airplane navigation systems would like this method.

Flight instruments including altimeter, autopilot, sensors, and appealing compass organize the global market. Due to the growing need for improved accuracy and passenger safety, altimeters dominated the market in 2018.

Flight Navigation System market share depends on key organizations and coordinated efforts. Navigation system companies often cooperate with aircraft manufacturers, flight providers, and innovation groups to develop their products and expand their markets. Collaboration can integrate navigation systems with other flying elements to meet the aviation industry's growing needs. These organizations collaborate on creative projects to share resources and expertise to enhance navigation.

Development is crucial for Flight Navigation System companies' market share. Companies invest much on innovation to meet changing business needs. Computerized reasoning, AI computations, and flexible navigation systems that adapt to changing flying circumstances may be developed. Navigation system vendors can meet expanding air traveler demands for efficiency, safety, and adaptability by staying ahead of mechanical trends.

Geographical focus is very important for Flight Navigation System market share. Companies can tailor their products and marketing to local aeronautics markets. Adjusting navigation systems to the unique airspace laws and requirements of different nations or districts allows vendors to identify major markets and form partnerships with local aviation partners.

Leave a Comment