Flat Roofing Systems Size

Flat Roofing Systems Market Growth Projections and Opportunities

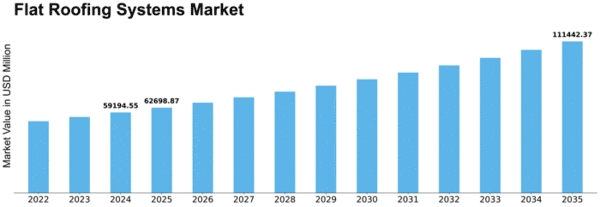

The global Flat Roofing Systems market is accounted to register a CAGR of 5.80% during the forecast period and is estimated to reach USD 52.81 billion by 2032.

Flat roofing systems play a crucial role in the construction industry, offering unique advantages and challenges. Several market factors influence the dynamics of the flat roofing systems market, shaping its growth and evolution. One key factor is the increasing trend toward sustainable and energy-efficient building solutions. As environmental concerns rise, flat roofing systems that incorporate green technologies, such as cool roofing materials and solar panels, gain traction. These sustainable options not only reduce energy consumption but also align with stringent building codes and standards promoting eco-friendly practices.

Economic factors significantly impact the market for flat roofing systems. Economic growth and stability directly influence construction activities, including the adoption of roofing solutions. In times of economic prosperity, there is typically increased investment in commercial and residential construction projects, leading to a higher demand for flat roofing systems. Conversely, economic downturns may result in reduced construction activities, impacting the market negatively. Understanding and adapting to these economic cycles is crucial for stakeholders in the flat roofing systems industry.

Technological advancements play a pivotal role in shaping the flat roofing systems market. Innovative materials and manufacturing processes improve the durability, insulation, and overall performance of flat roofs. Advancements in waterproofing technologies, such as synthetic membranes and coatings, enhance the longevity of flat roofing systems, reducing maintenance costs for building owners. Additionally, the integration of smart technologies, like sensors and monitoring systems, is becoming increasingly prevalent, providing real-time data on the condition of the roof and enabling proactive maintenance measures.

Regulatory factors are another crucial aspect influencing the flat roofing systems market. Building codes and regulations set by local and national authorities play a significant role in determining the type of roofing systems that can be used in different regions. Stricter building codes related to energy efficiency and safety standards often drive the adoption of certain types of flat roofing materials and designs. Manufacturers and contractors in the flat roofing systems market must stay abreast of these regulations to ensure compliance and market relevance.

The competitive landscape within the flat roofing systems market is shaped by various factors, including the availability of raw materials, manufacturing capabilities, and the presence of established market players. Raw material prices and their availability can impact production costs, influencing the overall competitiveness of flat roofing systems. Additionally, the ability of manufacturers to invest in research and development to create innovative products gives them a competitive edge. The market dynamics also depend on the distribution channels and partnerships that manufacturers establish, influencing their reach and market share.

Consumer preferences and trends in architectural design contribute to the market factors affecting flat roofing systems. Modern aesthetics, coupled with the demand for functional and versatile roof designs, drive innovation in flat roofing solutions. As consumers seek visually appealing and customizable options, manufacturers respond by developing roofing materials that cater to diverse architectural styles. The ability of flat roofing systems to seamlessly integrate with contemporary designs and meet aesthetic preferences is a significant factor influencing consumer choices.

Leave a Comment