Fishmeal Size

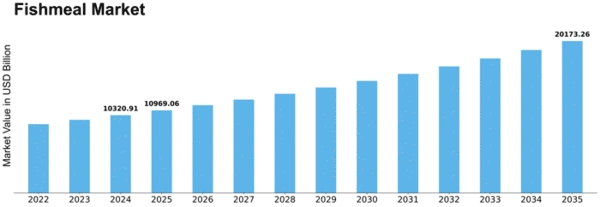

Fishmeal Market Growth Projections and Opportunities

Fishmeal Market is a fluid sector that is central to the global aquaculture and animal feed sectors. Changes in fishery resources, growth in the production of fish farms, shifting consumer preferences, and sustainability concerns are among many factors contributing to the market dynamics. In addition, dependence on fishery resources as a source of fishmeal production has also been considered by many authors to be one of the key drivers of market dynamics. The expanding aquaculture industry is another factor that shapes the dynamics of the fishmeal market. It is now one of the major users of high-quality protein made up of fishmeals used in aquafeed formulation. Aquaculture production has rapidly increased due to the growing global demand for fish and seafood products. This increase in aquaculture, therefore, requires an equivalent rise in the capacity and supply of fishmeal, thus driving market forces. Fluctuating consumer choices and eating habits play their part, too, in shaping these changing dynamics within this subsector, for example, how we eat our food in terms of different tastes or health issues. Fishmeals produced using specific types/species attempt to improve consumers' health awareness while meeting their premium seafood demands, too. There are environmental considerations at stake that do inform how companies would like to see this dynamic play out in the future. For example, maybe 'In terms of sustainability, there are some implications on the environment hence informing behavior and attitude towards this business which is a typical example'.Furthermore, the dynamism within the fishing sector does have certain rules governing it, i.e., who could catch what amount where when was determined by respective countries constituting regulatory regimes for fisheries; additionally, regulations were also enforced on quantity restrictions during capture as well as freedom assessments based on impact. Quality standards and food safety regulations also affect access to markets and consumer confidence with regard to meals derived from fish. Global economic conditions also influence market dynamics across the entire fishmeal industry. Pricing and availability of fishmeal can be impacted by economic factors like exchange rates, trade policies, and market competition. Consequently, market stakeholders need to remain flexible in order to adjust to those fluctuations. This article has mainly focused on the evolving dynamics encompassing fishery resource availability, aquaculture growth, changing consumer preferences, environmental sustainability considerations, and regulatory practices. Market participants, including producers, must pursue a strategic approach by sourcing sustainably, adapting to the ever-changing consumer behaviors, and complying with regulations that dictate their operations.

Leave a Comment