- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

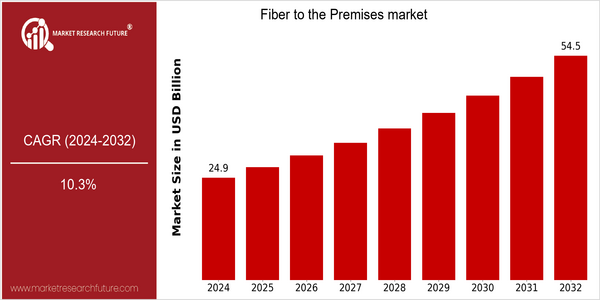

| Year | Value |

|---|---|

| 2024 | USD 24.88 Billion |

| 2032 | USD 54.51 Billion |

| CAGR (2024-2032) | 10.3 % |

Note – Market size depicts the revenue generated over the financial year

The Fiber to the Premises (FTTP) market is poised for significant growth, with a current market size of USD 24.88 billion in 2024, projected to reach USD 54.51 billion by 2032. This represents a robust compound annual growth rate (CAGR) of 10.3% over the forecast period. The increasing demand for high-speed internet connectivity, driven by the proliferation of smart devices and the rise of remote work, is a primary factor propelling this market forward. Additionally, advancements in fiber optic technology and the expansion of telecommunications infrastructure are further enhancing the deployment of FTTP solutions globally. Key players in the FTTP market, such as AT&T, Verizon, and Google Fiber, are actively investing in expanding their fiber networks and forming strategic partnerships to enhance service delivery. For instance, Verizon's ongoing initiatives to expand its Fios network and AT&T's investments in fiber infrastructure illustrate the competitive landscape's dynamic nature. These strategic moves not only reflect the companies' commitment to meeting the growing consumer demand for faster internet speeds but also highlight the overall trend towards digital transformation across various sectors. As the market continues to evolve, the emphasis on reliable and high-capacity broadband solutions will remain a critical driver of growth.

Regional Market Size

Regional Deep Dive

The Fiber to the Premises (FTTP) market is experiencing significant growth across various regions, driven by increasing demand for high-speed internet and advancements in telecommunications infrastructure. In North America, Europe, and Asia-Pacific, the push for digital transformation and smart city initiatives is propelling investments in fiber optic networks. Meanwhile, the Middle East and Africa are witnessing a surge in government-led initiatives aimed at enhancing connectivity, while Latin America is gradually adopting FTTP solutions to bridge the digital divide. Each region presents unique challenges and opportunities, influenced by local economic conditions, regulatory frameworks, and technological advancements.

Europe

- The European Union has set ambitious targets for digital infrastructure, with the Digital Compass 2030 initiative aiming for 100% coverage of gigabit networks across member states, driving FTTP deployment.

- Countries like Spain and Portugal are leading the way in FTTP adoption, with significant investments from companies such as Telefonica and Altice, which are expanding their fiber networks to meet growing consumer demand.

Asia Pacific

- China is rapidly expanding its FTTP infrastructure, with state-owned companies like China Telecom and China Unicom investing billions to enhance broadband access in urban and rural areas alike.

- Australia's National Broadband Network (NBN) is a significant government initiative aimed at providing high-speed fiber connections to millions of homes, with ongoing upgrades to existing infrastructure.

Latin America

- Brazil is seeing increased investment in FTTP networks, with companies like Vivo and Oi expanding their fiber offerings to meet the growing demand for high-speed internet in urban areas.

- Regulatory changes in countries like Colombia are encouraging private investment in fiber infrastructure, with the government promoting public-private partnerships to enhance connectivity.

North America

- The Federal Communications Commission (FCC) has launched initiatives to promote broadband expansion, including the Rural Digital Opportunity Fund, which aims to provide funding for FTTP projects in underserved areas.

- Major telecommunications companies like AT&T and Verizon are investing heavily in fiber networks, with AT&T announcing plans to reach 30 million locations with fiber by 2025, significantly enhancing service availability.

Middle East And Africa

- The UAE's government has launched the 'UAE Vision 2021' initiative, which includes plans to enhance digital infrastructure through FTTP, aiming to position the country as a global technology hub.

- In South Africa, the government is working with private sector partners to expand fiber networks, addressing the digital divide and improving internet access in rural communities.

Did You Know?

“As of 2023, over 1.5 billion people worldwide have access to fiber-optic broadband, a number that has doubled in the last five years, highlighting the rapid expansion of FTTP networks globally.” — International Telecommunication Union (ITU)

Segmental Market Size

The Fiber to the Premises (FTTP) segment plays a crucial role in the telecommunications market, currently experiencing robust growth driven by increasing consumer demand for high-speed internet and enhanced connectivity. Key factors propelling this demand include the rising need for bandwidth due to remote work and online education, as well as regulatory policies promoting broadband expansion in underserved areas. Notably, countries like South Korea and regions such as the European Union are leading in FTTP deployment, with companies like Google Fiber and Verizon making significant investments in infrastructure. FTTP is primarily implemented in residential and commercial settings, facilitating applications such as telecommuting, smart home technologies, and high-definition streaming services. The COVID-19 pandemic has accelerated the adoption of FTTP, as more individuals rely on stable internet connections for work and leisure. Additionally, sustainability initiatives are driving the shift towards fiber optics, which offer lower energy consumption compared to traditional copper lines. Technologies such as passive optical networks (PON) and advancements in fiber optic materials are shaping the segment's evolution, ensuring faster and more reliable internet access for users.

Future Outlook

The Fiber to the Premises (FTTP) market is poised for significant growth from 2024 to 2032, with the market value projected to increase from $24.88 billion to $54.51 billion, reflecting a robust compound annual growth rate (CAGR) of 10.3%. This growth trajectory is driven by the escalating demand for high-speed internet connectivity, particularly in urban and suburban areas where digital services are becoming increasingly essential. As more consumers and businesses seek reliable and fast internet solutions, FTTP is expected to penetrate deeper into the market, with usage rates potentially reaching over 60% in developed regions by 2032, compared to approximately 30% in 2024. Key technological advancements, such as the deployment of next-generation passive optical networks (PON) and advancements in fiber optic technology, will play a crucial role in enhancing the efficiency and scalability of FTTP networks. Additionally, supportive government policies aimed at expanding broadband access, particularly in underserved areas, will further catalyze market growth. Emerging trends, including the integration of FTTP with smart home technologies and the increasing adoption of cloud-based services, will also shape the landscape, driving demand for faster and more reliable internet connections. As the market evolves, stakeholders must remain agile to capitalize on these opportunities and address the challenges posed by competition and infrastructure investments.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 20.45 Billion |

| Market Size Value In 2023 | USD 23.63 Billion |

| Growth Rate | 10.62% (2023-2030) |

Fiber to the Premises Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.