Rising Infertility Rates

The rising rates of infertility are a significant driver for the fertility supplements Market. Factors such as delayed childbearing, lifestyle choices, and environmental influences have contributed to increased infertility rates among couples. As a result, there is a heightened demand for fertility supplements that promise to enhance reproductive health. Recent statistics indicate that approximately 15% of couples experience infertility, which has prompted many to seek out dietary supplements as a complementary approach to traditional medical treatments. This growing concern about infertility is likely to sustain the demand for fertility supplements, thereby propelling market growth in the coming years.

Growth of Online Retail Channels

The growth of online retail channels is transforming the Fertility Supplements Market. E-commerce platforms provide consumers with convenient access to a wide range of fertility supplements, often accompanied by detailed product information and customer reviews. This accessibility is particularly appealing to those who may feel uncomfortable discussing fertility issues in traditional retail settings. Data indicates that online sales of dietary supplements have surged, with e-commerce expected to account for a significant portion of total sales in the fertility supplements market. This trend not only facilitates consumer choice but also encourages competition among brands, ultimately benefiting the market as a whole.

Advancements in Nutritional Science

Advancements in nutritional science play a crucial role in shaping the Fertility Supplements Market. Research into the impact of specific vitamins, minerals, and herbal ingredients on reproductive health has led to the development of targeted supplements. For instance, studies suggest that folic acid, zinc, and omega-3 fatty acids may enhance fertility outcomes. As scientific evidence continues to emerge, consumers are increasingly inclined to invest in supplements that are backed by research. This trend is reflected in the market, where products formulated with scientifically validated ingredients are gaining traction, potentially leading to a more informed consumer base and increased sales in the fertility supplements sector.

Increasing Awareness of Fertility Health

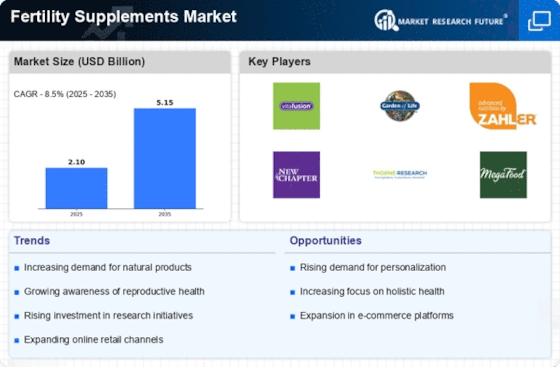

The rising awareness surrounding fertility health is a pivotal driver for the Fertility Supplements Market. As individuals and couples become more informed about reproductive health, there is a growing demand for supplements that support fertility. Educational campaigns and social media discussions have contributed to this awareness, leading to an increase in the number of consumers seeking fertility-enhancing products. According to recent data, the fertility supplements market is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years. This trend indicates a shift in consumer behavior, where proactive health management is prioritized, thereby expanding the market for fertility supplements.

Shift Towards Holistic Health Approaches

The shift towards holistic health approaches is influencing the Fertility Supplements Market significantly. Consumers are increasingly seeking natural and organic products that align with their overall wellness goals. This trend is evident in the rising popularity of fertility supplements that incorporate herbal ingredients and natural compounds. As individuals become more health-conscious, they are more likely to choose supplements that are perceived as safe and effective. This inclination towards holistic health not only enhances the appeal of fertility supplements but also encourages manufacturers to innovate and diversify their product offerings, thereby expanding the market landscape.