Market Analysis

In-depth Analysis of Federal Edge Computing Market Industry Landscape

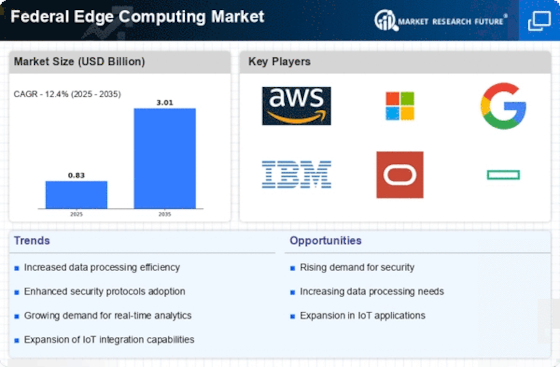

The Federal Edge Computing Market is an extremely dynamic sector influenced by multiple market factors determining its growth and direction overall. One of the main drivers behind market dynamics is decentralized data processing needs emerging at many Federal agencies, as communicated earlier in this paper. Technological innovation serves as one of the cornerstones upon which the Federal Edge Computing Market hinges. Evolving solutions meant for state institutions' specific needs result from advances in miniaturized hardware devices used for edge computing purposes. These energy-efficient algorithms can process every data bit effectively and secure the transmission of information protocols. Other innovations include ruggedized edge devices, secure edge analytics, and AI applications for federal agencies with low-powered computing capabilities. The global economy shapes Federal Edge Computing. Changes in economic conditions can affect government investment decisions, thereby impacting technology spending and infrastructure development. The Federal Edge Computing Market depends considerably on regulatory compliance and security issues. The use of information systems in government institutions is limited by strict rules that are designed to protect both government information and personal privacy issues for all involved parties (Kolias et al., 2017). Thus, such solutions become highly demanded because they conform to existing federal regulations, securing them against any threats or hazardous incidents that can happen anytime within their operational domain. This strategy not only attracts customers but also positions the vendors as trusted allies to US government departments and agencies by ensuring safe and compliant edge computing services. Finally, competition influences the market heavily. Many different providers offer this kind of service, so it has become quite fierce out there among them! Such factors enabling differentiation, like availability of robust security features, scalability, compatibility with previous state software programs, and compliances towards governmental norms, form important considerations when a federal agency decides upon an appropriate edge-computing provider. The market is influenced greatly by customer preferences and industry trends. When it comes to edge computing, US federal agencies are adopting new trends. These trends have also affected the deployment of critical infrastructure in the field of defense applications and the integration of Government IoT deployments in edge analytics. The interoperability with existing government systems is one of the issues for the adoption of Federal Edge Computing solutions. For instance, supply chain considerations play a significant role in determining how the Federal Edge Computing market operates as government agencies evaluate hardware components sourcing and deployment, such as edge devices. Trade tensions and regulatory environments can affect geopolitical factors, which may, in turn, impact the Federal Edge Computing market. Environmental sustainability is a new driver in the Federal Edge Computing market as far as its development is concerned since most governments globally focus on sustainability initiatives, hence increasing awareness about the environmental impact brought about by technology products. Edge computing solutions that stress energy efficiency, resource optimization, and eco-friendly practices reflect environmental concerns being raised by governments, thus contributing to the market's responsiveness.

Leave a Comment