Rising Health Consciousness

The increasing focus on health and wellness is significantly influencing The Global Eyewear Industry. Consumers are becoming more health-conscious, leading to a greater emphasis on protective eyewear that shields against harmful environmental factors. For instance, the demand for sunglasses with UV protection and blue light filtering capabilities is on the rise, as individuals seek to mitigate the adverse effects of prolonged screen exposure and sun damage. Market Research Future indicates that the protective eyewear segment is expected to witness substantial growth, driven by heightened awareness of eye health. Additionally, the integration of health-related features in eyewear, such as anti-fatigue lenses, is appealing to consumers who prioritize both style and functionality. This trend underscores the potential for eyewear brands to capitalize on the health-conscious consumer base, thereby driving market expansion.

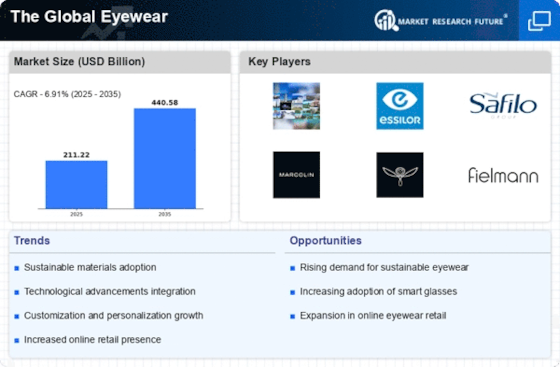

Technological Advancements in Eyewear

Technological innovations in eyewear are transforming the landscape of The Global Eyewear Industry. The advent of smart eyewear, which integrates augmented reality and health-monitoring features, is capturing consumer interest. For instance, smart glasses equipped with heads-up displays and fitness tracking capabilities are gaining traction among tech-savvy consumers. Additionally, advancements in lens technology, such as blue light blocking and photochromic lenses, are addressing modern lifestyle needs, particularly among digital device users. The market for smart eyewear is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. These technological enhancements not only improve functionality but also appeal to a younger demographic, thereby expanding the consumer base and driving overall market growth.

E-commerce Growth and Online Retailing

The e-commerce eyewear market is revolutionizing how consumers purchase vision correction and fashion eyewear products. With advanced virtual try-on technologies and AI-powered recommendation systems, the e-commerce eyewear market has eliminated traditional barriers associated with online eyewear purchases. Industry projections indicate that the e-commerce eyewear market will account for over 35% of total eyewear sales by 2030, driven by enhanced customer experience, competitive pricing, and doorstep delivery convenience. This digital transformation is particularly prominent among millennial and Gen-Z consumers who prefer the seamless shopping experience offered by e-commerce platforms.

Increasing Vision Impairment Awareness

The rising awareness regarding vision impairment and its impact on quality of life appears to be a pivotal driver in The Global Eyewear Industry. As populations age, the prevalence of vision-related issues such as myopia, hyperopia, and presbyopia is likely to increase. Reports indicate that by 2050, nearly half of the global population may be affected by myopia, necessitating corrective eyewear. This growing concern has led to heightened demand for prescription glasses and contact lenses, thereby propelling market growth. Furthermore, educational campaigns aimed at promoting regular eye examinations are fostering a culture of proactive eye care, which could further stimulate the eyewear market. Consequently, the increasing incidence of vision impairment is expected to significantly influence consumer purchasing behavior, driving sales in the eyewear sector.

Fashion Trends and Eyewear as Accessories

The evolving perception of eyewear as a fashion statement rather than merely a functional item is a notable driver in The Global Eyewear Industry. Consumers increasingly view eyewear as an essential accessory that complements their personal style. This trend is particularly pronounced among younger demographics, who are more inclined to experiment with various styles, colors, and brands. The rise of social media influencers and celebrity endorsements has further amplified this trend, as consumers seek to emulate the styles of their favorite personalities. Market data suggests that the eyewear segment, particularly sunglasses, is experiencing robust growth, with sales projected to reach several billion dollars in the next few years. This shift towards fashion-oriented eyewear is likely to encourage brands to innovate and diversify their product offerings, thereby enhancing market competitiveness.