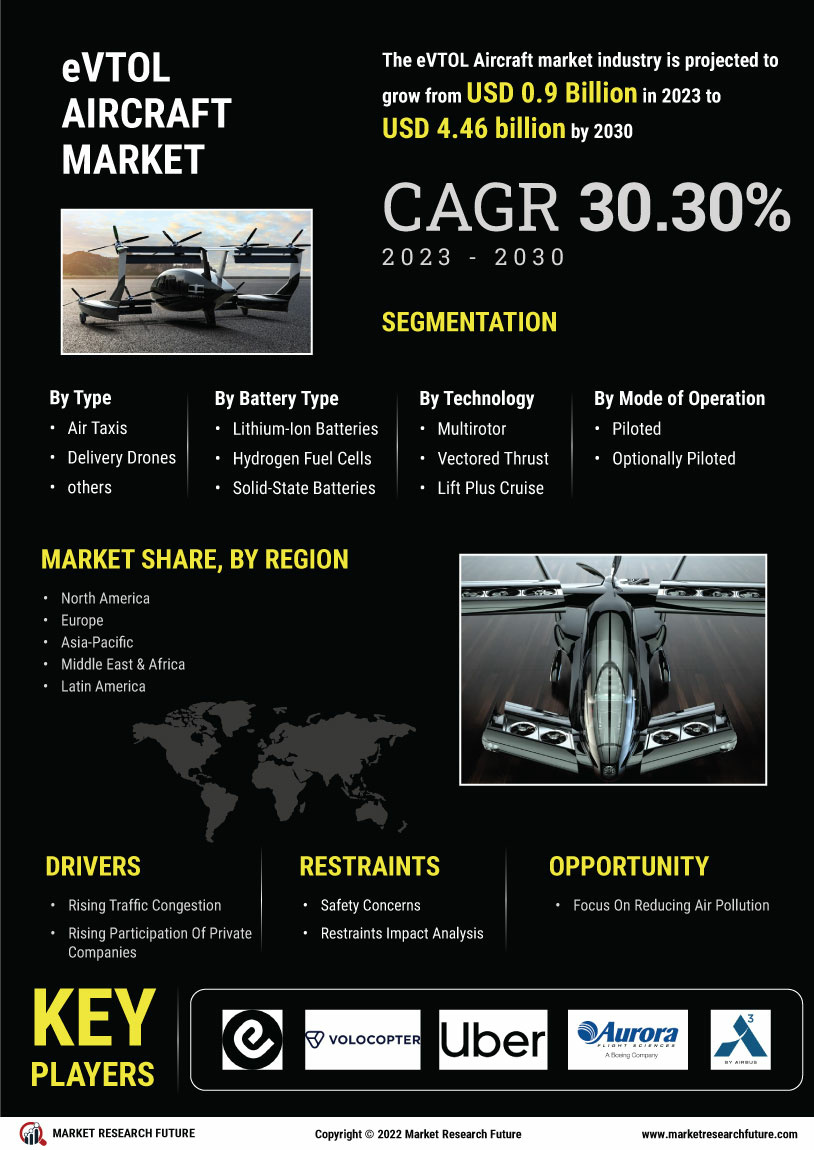

Urban Air Mobility Demand

The eVTOL Aircraft Market is witnessing a surge in demand for urban air mobility solutions. As urban populations continue to grow, traditional ground transportation systems are becoming increasingly congested. This congestion leads to longer commute times and a pressing need for alternative transportation methods. eVTOL aircraft offer a potential solution by providing rapid transit options that can bypass ground traffic. According to recent estimates, the urban air mobility market could reach a valuation of several billion dollars by the end of the decade, driven by the need for efficient transportation in densely populated areas. This demand is likely to propel the eVTOL Aircraft Market forward, as cities explore innovative ways to integrate aerial transport into their existing infrastructure.

Investment Trends in Aerospace Sector

The eVTOL Aircraft Market is experiencing a notable increase in investment trends within the aerospace sector. Venture capital and private equity firms are increasingly directing funds towards eVTOL startups and established companies developing this technology. This influx of capital is essential for research, development, and scaling production capabilities. Recent reports indicate that investments in eVTOL technologies have reached hundreds of millions of dollars, reflecting a strong belief in the market's potential. As more investors recognize the transformative impact of eVTOL aircraft on transportation, the eVTOL Aircraft Market is likely to see accelerated growth, leading to advancements in technology and increased competition among manufacturers.

Technological Innovations in Aviation

The eVTOL Aircraft Market is being propelled by rapid technological innovations in aviation. Advances in battery technology, materials science, and aerodynamics are enabling the development of more efficient and capable eVTOL aircraft. For instance, improvements in energy density of batteries are extending flight ranges and reducing charging times, which are critical factors for commercial viability. Furthermore, innovations in autonomous flight systems are enhancing safety and operational efficiency. The integration of these technologies is expected to create a more robust eVTOL Aircraft Market, with projections indicating a compound annual growth rate that could exceed 20% over the next decade. This technological momentum is likely to attract further investment and interest in the sector.

Environmental Sustainability Initiatives

The eVTOL Aircraft Market is increasingly aligned with environmental sustainability initiatives. As concerns about climate change and air pollution intensify, there is a growing emphasis on reducing carbon emissions from transportation. eVTOL aircraft, which are often designed to be electric or hybrid, present a cleaner alternative to traditional aviation and ground transport. The potential for reduced noise pollution and lower emissions positions eVTOLs as a favorable option for urban environments. Recent studies suggest that the adoption of eVTOL technology could significantly decrease the carbon footprint of urban transportation systems, thereby enhancing the appeal of the eVTOL Aircraft Market to environmentally conscious consumers and regulators alike.

Government Support and Policy Frameworks

The eVTOL Aircraft Market is benefiting from supportive government policies and frameworks aimed at fostering innovation in aviation. Various governments are recognizing the potential of eVTOL technology to address urban mobility challenges and are actively investing in research and development. Initiatives such as funding for pilot projects and the establishment of regulatory frameworks for eVTOL operations are becoming more common. These supportive measures are likely to create a conducive environment for the growth of the eVTOL Aircraft Market. As regulatory bodies work to establish safety standards and operational guidelines, the industry is expected to gain legitimacy and attract more stakeholders, further enhancing its growth prospects.