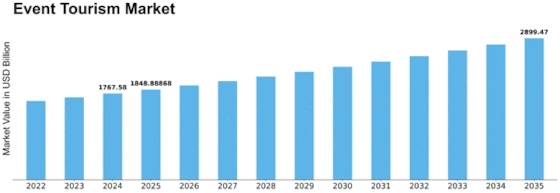

Event Tourism Size

Event Tourism Market Growth Projections and Opportunities

The event tourism market is influenced by a myriad of factors that contribute to its growth and dynamics, reflecting the intersection of travel, leisure, and experiential events. One primary driver is the increasing desire for unique and memorable experiences. As consumers seek more than traditional vacations, the demand for events, festivals, conferences, and cultural happenings has surged. Event tourism satisfies the craving for novel experiences, offering travelers the opportunity to immerse themselves in diverse cultures, celebrations, and themed gatherings.

Economic factors play a crucial role in the event tourism market. The economic health of a region can impact both the frequency and scale of events hosted. Strong economies often result in increased spending on leisure activities, including event tourism. Additionally, events themselves can contribute significantly to the local economy by attracting visitors who spend on accommodation, dining, transportation, and local attractions.

Government policies and support are integral to the success of the event tourism market. Supportive policies, financial incentives, and efficient infrastructure contribute to attracting and hosting events. Governments may invest in event venues, transportation networks, and promotional campaigns to position their regions as attractive destinations for conferences, festivals, and other events. Political stability and favorable regulations further enhance the appeal of a destination for event organizers.

Technological advancements play a significant role in the event tourism market. The use of technology, including event management software, mobile apps, and virtual reality, enhances the overall event experience for attendees and organizers alike. Technology facilitates efficient planning, marketing, and execution of events, contributing to the industry's growth and ensuring a seamless experience for participants.

Social and cultural factors influence the event tourism market, with preferences and trends shaping the types of events that gain popularity. Cultural festivals, music concerts, sporting events, and business conferences cater to diverse interests and demographics. Changing societal preferences for experiences over possessions contribute to the growth of the event tourism market, as consumers prioritize spending on memorable moments.

Environmental sustainability considerations are gaining importance in the event tourism market. Event organizers, destinations, and participants are increasingly mindful of the environmental impact of large gatherings. Sustainable practices, such as waste reduction, eco-friendly transportation options, and responsible event planning, contribute to the attractiveness of destinations for environmentally conscious event tourism.

Global connectivity and ease of travel are key factors driving the event tourism market. With improved transportation infrastructure and accessibility, individuals can attend events in different parts of the world more easily. The rise of budget airlines, efficient public transportation, and digital platforms for travel booking make it convenient for participants to explore event opportunities beyond their local regions.

Marketing and promotional efforts significantly impact the event tourism market. Destinations and event organizers leverage effective marketing strategies to attract attendees and sponsors. Social media, online advertising, and influencer partnerships play a crucial role in creating awareness and generating interest in upcoming events. Successful marketing campaigns contribute to the overall success of events and the sustained growth of the event tourism market.

Security and safety considerations are paramount in the event tourism market. Ensuring the safety of participants and maintaining a secure environment is critical for the success of any event. Destinations that prioritize safety measures and have effective emergency response plans are more likely to attract organizers and participants, fostering a positive reputation in the event tourism industry.

Competitive dynamics among destinations influence the event tourism market. Regions vie for the opportunity to host prestigious events that can enhance their global visibility and reputation. The bidding process for major conferences, sports events, and cultural festivals is highly competitive, with destinations competing to offer attractive packages, infrastructure, and logistical support to secure hosting rights.

Leave a Comment