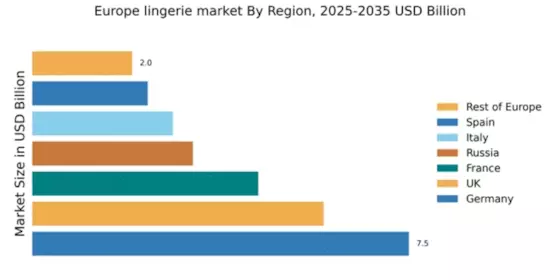

Germany : Strong Demand and Innovation Drive Growth

Germany holds a commanding 7.5% market share in the European lingerie sector, valued at approximately €1.5 billion. Key growth drivers include a rising focus on sustainability, innovative designs, and a growing preference for online shopping. Regulatory policies promoting fair trade and consumer protection further enhance market stability. The robust infrastructure and industrial development in cities like Berlin and Munich support efficient distribution and retail operations.

UK : Evolving Trends Shape Consumer Choices

The UK lingerie market accounts for 5.8% of the European share, valued at around €1.2 billion. Growth is driven by changing consumer preferences towards inclusivity and body positivity, alongside a surge in e-commerce. Government initiatives supporting small businesses and online retail have bolstered market access. The competitive landscape features major players like Victoria's Secret and Aerie, particularly in urban centers like London and Manchester, where demand for luxury and affordable options coexists.

France : Heritage Meets Modern Innovation

France captures 4.5% of the European lingerie market, valued at approximately €900 million. The growth is fueled by the country's rich fashion heritage and a strong inclination towards luxury brands. Regulatory frameworks promoting ethical production practices are gaining traction. Key markets include Paris and Lyon, where high-end boutiques thrive. Major players like Chantelle and Triumph International dominate, creating a competitive environment that emphasizes quality and design, appealing to both local and international consumers.

Russia : Growing Demand for Quality Products

Russia holds a 3.2% share of the European lingerie market, valued at about €650 million. The market is driven by increasing disposable incomes and a shift towards premium products. Government initiatives aimed at boosting local manufacturing are also significant. Key cities like Moscow and St. Petersburg are central to market dynamics, with a mix of local and international brands competing. Major players include Wacoal and local brands, reflecting a diverse consumer base seeking quality and affordability.

Italy : Luxury Meets Everyday Comfort

Italy represents 2.8% of the European lingerie market, valued at around €550 million. The growth is attributed to a strong tradition of craftsmanship and a rising demand for luxury lingerie. Regulatory policies supporting artisanal production are beneficial. Key markets include Milan and Florence, where high-end brands flourish. Major players like Triumph International and local artisans create a competitive landscape that emphasizes quality and design, appealing to both domestic and international consumers.

Spain : Diverse Styles Cater to All Tastes

Spain accounts for 2.3% of the European lingerie market, valued at approximately €450 million. Growth is driven by a blend of traditional and modern styles, catering to diverse consumer preferences. Government initiatives promoting local brands and sustainable practices are gaining momentum. Key markets include Barcelona and Madrid, where both local and international brands compete. Major players like Victoria's Secret and local brands create a dynamic environment, reflecting Spain's rich cultural heritage in lingerie design.

Rest of Europe : Diverse Opportunities Across Regions

The Rest of Europe holds a 1.99% share of the lingerie market, valued at around €400 million. Growth is driven by increasing awareness of lingerie fashion and rising disposable incomes in emerging markets. Regulatory frameworks vary significantly, impacting market entry strategies. Key markets include Eastern European countries where local brands are gaining traction. The competitive landscape features a mix of international and local players, creating opportunities for niche brands to thrive in specific regions.