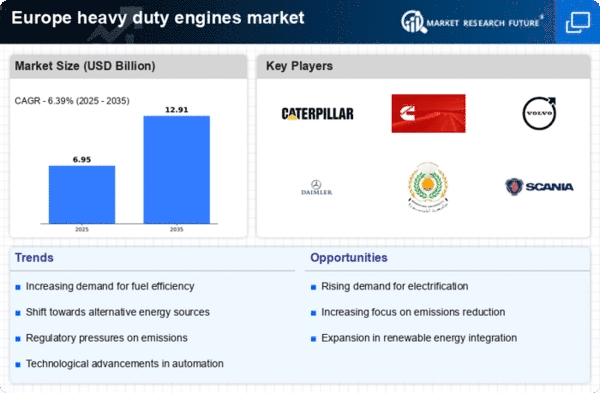

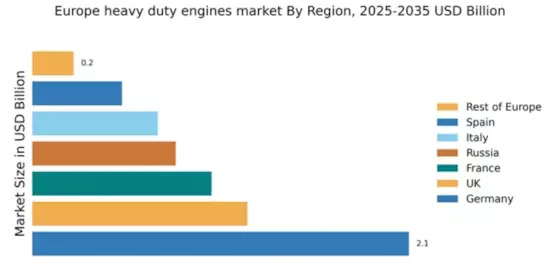

Germany : Strong industrial base drives growth

Key markets include cities like Stuttgart, Munich, and Hamburg, which are hubs for automotive and manufacturing industries. The competitive landscape features major players such as Daimler AG and MAN SE, alongside international firms like Caterpillar and Cummins. The local business environment is characterized by a focus on innovation and sustainability, with applications spanning transportation, construction, and agriculture sectors.

UK : Adapting to new regulations

Key markets include London, Birmingham, and Manchester, where logistics and transportation industries thrive. The competitive landscape features players like Volvo Group and Scania AB, alongside local firms. The business environment is adapting to new regulations, fostering innovation in engine technology, particularly in the transportation and construction sectors.

France : Strong demand across sectors

Key markets include Paris, Lyon, and Marseille, where construction and agriculture are prominent. The competitive landscape features major players like Volvo Group and Cummins, alongside local manufacturers. The business environment is dynamic, with a focus on innovation and sustainability, particularly in the construction and agricultural sectors.

Russia : Growth driven by infrastructure needs

Key markets include Moscow, St. Petersburg, and regions rich in natural resources. The competitive landscape features both local and international players, including Caterpillar and Volvo. The business environment is improving, with a focus on local production and partnerships, particularly in the mining and construction sectors.

Italy : Key player in automotive sector

Key markets include Turin, Milan, and Bologna, where automotive and construction industries are prominent. The competitive landscape features major players like Fiat and MAN SE, alongside international firms. The business environment is characterized by innovation and a focus on sustainability, particularly in the automotive and construction sectors.

Spain : Focus on efficiency and sustainability

Key markets include Madrid, Barcelona, and Valencia, where logistics and transportation industries are thriving. The competitive landscape features players like Scania and Volvo, alongside local manufacturers. The business environment is evolving, with a focus on innovation and sustainability, particularly in logistics and transportation applications.

Rest of Europe : Diverse needs across regions

Key markets include regions in Eastern Europe, where agriculture and construction are significant. The competitive landscape features a mix of local and international players, including PACCAR and Navistar. The business environment varies widely, with opportunities in sectors like agriculture, construction, and transportation, driven by local market dynamics.