Increasing Health Awareness

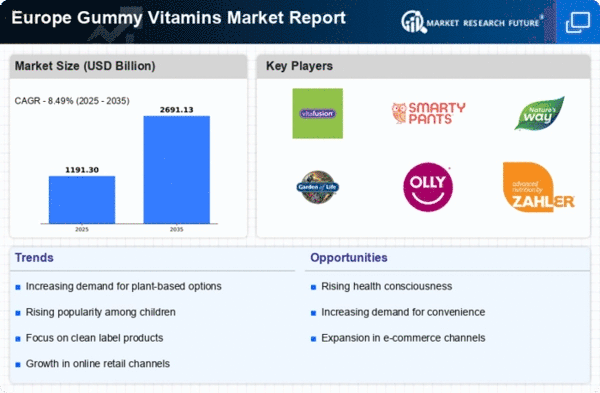

The growing awareness of health and wellness among consumers in Europe is a pivotal driver for the gummy vitamins market. As individuals become more conscious of their nutritional intake, the demand for supplements that are both effective and enjoyable is on the rise. This trend is reflected in the market, where gummy vitamins are perceived as a more palatable alternative to traditional tablets and capsules. According to recent data, the gummy vitamins segment has experienced a growth rate of approximately 15% annually in Europe. This shift towards more appealing forms of vitamins is likely to continue, as consumers increasingly seek products that align with their health goals while also providing a pleasant consumption experience.

Innovative Product Development

Innovation plays a crucial role in the gummy vitamins market, as manufacturers continuously strive to create new formulations that cater to diverse consumer needs. The introduction of specialized gummy vitamins targeting specific demographics, such as children, seniors, and athletes, has expanded the market significantly. For instance, products enriched with probiotics, omega-3 fatty acids, and herbal extracts are gaining traction. This innovation is not only enhancing the product offerings but also driving sales, with the market projected to reach €1 billion by 2026. The emphasis on unique flavors and functional benefits is likely to attract a broader audience, further propelling the growth of the gummy vitamins market.

Expansion of Retail Distribution Channels

The expansion of retail distribution channels is a significant driver for the gummy vitamins market in Europe. With the rise of health-focused retail outlets, supermarkets, and pharmacies, consumers have greater access to a variety of gummy vitamin products. Additionally, the integration of online platforms has further facilitated this accessibility, allowing consumers to purchase products conveniently from their homes. Recent statistics suggest that online sales of gummy vitamins have increased by 30% in the past year alone. This enhanced distribution network not only boosts visibility but also encourages impulse purchases, thereby contributing to the overall growth of the gummy vitamins market.

Rising Popularity of Preventive Healthcare

The increasing focus on preventive healthcare is significantly influencing the gummy vitamins market in Europe. Consumers are increasingly prioritizing supplements that support overall health and prevent potential health issues. This trend is evident in the rising sales of gummy vitamins that promote immunity, digestive health, and mental well-being. Market analysis indicates that the preventive healthcare segment is expected to grow by 20% over the next five years, with gummy vitamins playing a central role in this shift. As more individuals adopt proactive health measures, the demand for gummy vitamins that offer preventive benefits is likely to surge, thereby enhancing the market landscape.

Consumer Preference for Natural Ingredients

The growing consumer preference for natural and organic ingredients is reshaping the gummy vitamins market in Europe. As individuals become more discerning about the products they consume, there is a marked shift towards gummy vitamins that are free from artificial additives and preservatives. This trend is supported by a significant portion of the population actively seeking clean label products. Market data indicates that sales of organic gummy vitamins have increased by 25% in the last year, reflecting this consumer demand. As manufacturers respond to this trend by reformulating their products to include natural ingredients, the gummy vitamins market is likely to experience sustained growth.