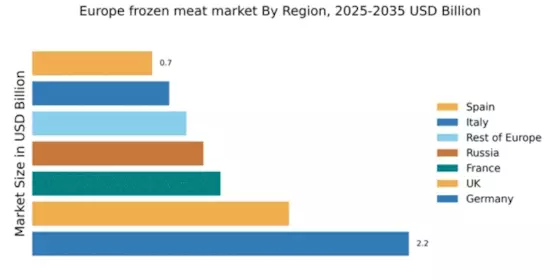

Germany : Strong Demand and Infrastructure Growth

Germany holds a dominant market share of 2.2 in the European frozen meat sector, driven by increasing consumer demand for convenience foods and a growing preference for high-quality meat products. The country benefits from robust regulatory frameworks that support food safety and quality standards, alongside government initiatives promoting local production. Infrastructure improvements, including advanced cold chain logistics, further enhance market accessibility and efficiency.

UK : Rising Demand for Convenience Foods

The UK frozen meat market accounts for 1.5 of the European share, with growth fueled by busy lifestyles and a shift towards ready-to-cook meals. Consumer trends indicate a preference for frozen products due to their longer shelf life and reduced food waste. Regulatory support for food safety and quality assurance is strong, ensuring compliance with EU standards, even post-Brexit. Investment in cold storage facilities is also on the rise, enhancing distribution capabilities.

France : Quality and Sustainability Focus

France captures 1.1 of the European frozen meat market, characterized by a strong emphasis on gourmet and organic products. The growth is driven by consumer interest in high-quality, sustainably sourced meats, supported by government initiatives promoting local agriculture. Regulatory policies ensure strict adherence to food safety standards, fostering consumer trust. The market is also influenced by seasonal demand, particularly during holidays and festivals, boosting sales of premium frozen meats.

Russia : Growth Amid Economic Challenges

With a market share of 1.0, Russia's frozen meat sector is gradually expanding, driven by increasing domestic consumption and a shift towards self-sufficiency in food production. Government initiatives aimed at boosting local meat production and reducing imports are key growth drivers. Regulatory frameworks are evolving to enhance food safety standards, while infrastructure improvements in logistics and distribution are critical for market development. The demand for frozen meat is particularly strong in urban areas.

Italy : Culinary Heritage Meets Convenience

Italy holds a 0.8 share in the frozen meat market, where traditional culinary practices intersect with modern convenience trends. The growth is supported by increasing consumer interest in ready-to-cook meals that reflect regional flavors. Regulatory policies emphasize food quality and safety, aligning with EU standards. Key markets include major cities like Milan and Rome, where competition is fierce among local and international players, including significant brands like Cargill and Tyson Foods.

Spain : Cultural Shifts in Eating Habits

Spain's frozen meat market, accounting for 0.7 of the European share, is experiencing growth due to changing consumer habits and a rising preference for convenience. The market is influenced by traditional Spanish cuisine, with frozen products increasingly used in everyday meals. Regulatory frameworks ensure compliance with food safety standards, while government initiatives support local meat producers. Key cities like Madrid and Barcelona are central to market dynamics, with major players like JBS and Hormel Foods active in the region.

Rest of Europe : Varied Preferences Across Regions

The Rest of Europe captures a 0.9 share of the frozen meat market, characterized by diverse consumer preferences and varying market dynamics. Growth is driven by regional tastes and increasing demand for convenience foods. Regulatory policies differ across countries, impacting market entry and competition. Infrastructure development is uneven, with some areas benefiting from advanced logistics while others lag behind. Key players like Danish Crown and Smithfield Foods are expanding their presence in these markets.