Integration with Advanced Technologies

The Europe Electronic Data Interchange Edi Software Market is increasingly characterized by the integration of advanced technologies such as artificial intelligence (AI) and blockchain. These technologies enhance the capabilities of EDI systems, enabling businesses to automate complex processes and improve data accuracy. AI-driven analytics can provide valuable insights into transaction patterns, while blockchain technology offers enhanced security and transparency in data exchanges. As organizations seek to leverage these technologies to gain a competitive edge, the demand for EDI solutions that incorporate AI and blockchain is expected to rise. This integration not only streamlines operations but also fosters innovation within the European EDI landscape.

Regulatory Compliance and Data Security

In the Europe Electronic Data Interchange Edi Software Market, compliance with stringent regulations such as the General Data Protection Regulation (GDPR) is paramount. Organizations are increasingly prioritizing EDI solutions that ensure data security and compliance with legal standards. The need for secure data transmission and storage is driving the demand for EDI software that incorporates advanced encryption and authentication protocols. As businesses face potential penalties for non-compliance, the market for EDI solutions that offer robust security features is expected to expand significantly. This focus on compliance not only protects sensitive information but also enhances trust among trading partners, thereby fostering smoother business transactions.

Growing Adoption of Cloud-Based Solutions

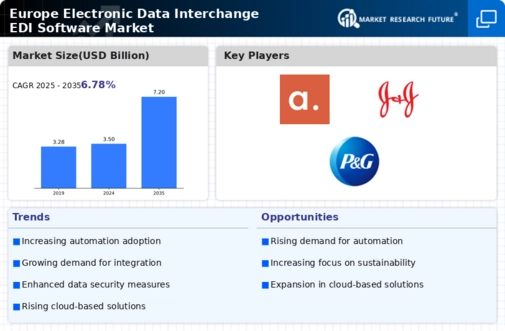

The Europe Electronic Data Interchange Edi Software Market is witnessing a marked shift towards cloud-based solutions. This transition is driven by the increasing need for flexibility, scalability, and cost-effectiveness among businesses. Cloud-based EDI systems allow organizations to streamline their operations, reduce IT overhead, and enhance collaboration with trading partners. According to recent data, the cloud EDI segment is projected to grow at a compound annual growth rate of over 15% in Europe, reflecting the growing preference for Software as a Service (SaaS) models. This trend not only facilitates real-time data exchange but also supports remote work environments, which are becoming more prevalent in the European business landscape.

Rising Demand for Real-Time Data Exchange

The Europe Electronic Data Interchange Edi Software Market is experiencing a surge in demand for real-time data exchange capabilities. As businesses strive for agility and responsiveness, the ability to access and share information instantaneously has become a critical requirement. EDI solutions that offer real-time data processing enable organizations to make informed decisions quickly, thereby improving customer satisfaction and operational performance. This trend is particularly evident in sectors such as retail and logistics, where timely information is essential for inventory management and order fulfillment. The market for EDI software that supports real-time data exchange is projected to grow, reflecting the increasing need for businesses to adapt to rapidly changing market conditions.

Increased Focus on Supply Chain Efficiency

The Europe Electronic Data Interchange Edi Software Market is significantly influenced by the growing emphasis on supply chain efficiency. Companies are increasingly recognizing the importance of optimizing their supply chains to remain competitive in a globalized market. EDI software plays a crucial role in facilitating seamless communication and data exchange between suppliers, manufacturers, and retailers. By automating processes such as order processing and inventory management, businesses can reduce lead times and minimize errors. Recent studies indicate that organizations utilizing EDI solutions can achieve up to a 30% reduction in order processing times, thereby enhancing overall operational efficiency and responsiveness to market demands.