Government Initiatives and Funding

Government initiatives play a crucial role in shaping the 5G Infrastructure Market in Europe. Various European nations have launched programs aimed at accelerating the deployment of 5g networks. For instance, the European Commission has allocated €20 billion to support digital infrastructure projects, including 5g. This funding is intended to enhance connectivity in rural and underserved areas, ensuring equitable access to high-speed internet. Additionally, regulatory frameworks are being established to streamline the rollout of 5g infrastructure, which is expected to foster competition among service providers. As a result, these initiatives are likely to stimulate investment and innovation within the 5g infrastructure market.

Increased Adoption of Smart Technologies

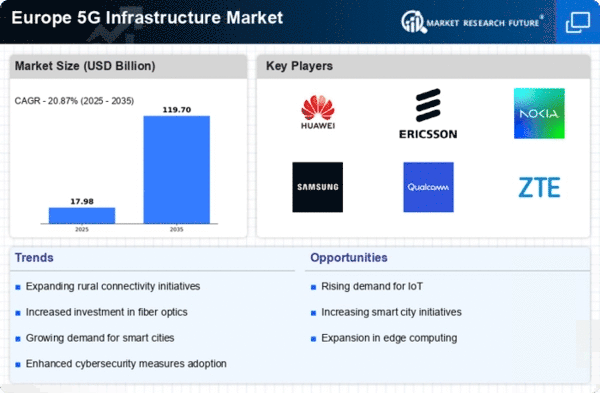

The increased adoption of smart technologies across various sectors is a significant driver of the 5G Infrastructure Market. Industries such as healthcare, automotive, and manufacturing are increasingly leveraging 5g capabilities to enhance operational efficiency and improve service delivery. For instance, smart factories utilizing 5g technology can achieve up to 30% reduction in operational costs through real-time data analytics and automation. Additionally, the automotive sector is witnessing a surge in connected vehicles, which rely on 5g for seamless communication and data exchange. This trend is expected to contribute to a compound annual growth rate (CAGR) of over 25% in the 5g infrastructure market by 2027.

Rising Demand for High-Speed Connectivity

The increasing demand for high-speed connectivity in Europe is a primary driver of the 5G Infrastructure Market. As businesses and consumers seek faster internet speeds, the need for robust 5g networks becomes evident. In 2025, it is estimated that mobile data traffic in Europe will reach approximately 50 exabytes per month, highlighting the necessity for advanced infrastructure. This surge in demand is not only driven by consumer usage but also by the growing number of IoT devices, which are projected to exceed 1 billion in Europe by 2026. Consequently, telecom operators are investing heavily in 5g infrastructure to meet these demands, thereby propelling market growth.

Competitive Landscape Among Telecom Operators

The competitive landscape among telecom operators in Europe is intensifying, serving as a catalyst for the 5G Infrastructure Market. Major players are engaged in aggressive strategies to capture market share, including partnerships, mergers, and acquisitions. This competition is driving innovation and investment in 5g technologies, as operators strive to differentiate their services. In 2025, it is anticipated that the number of 5g subscriptions in Europe will surpass 200 million, prompting operators to enhance their infrastructure capabilities. Furthermore, the entry of new players into the market is likely to increase competition, leading to improved service offerings and pricing strategies, which will further stimulate growth in the 5g infrastructure market.

Technological Advancements in Network Equipment

Technological advancements in network equipment are significantly influencing the 5G Infrastructure Market. Innovations in hardware and software are enabling telecom operators to deploy more efficient and scalable networks. For example, the introduction of Massive MIMO technology allows for increased capacity and improved signal quality, which is essential for supporting the anticipated growth in data traffic. In 2025, it is projected that the market for 5g network equipment in Europe will exceed €10 billion, driven by these technological improvements. Furthermore, the integration of artificial intelligence and machine learning in network management is enhancing operational efficiency, thereby attracting further investments in the 5g infrastructure market.