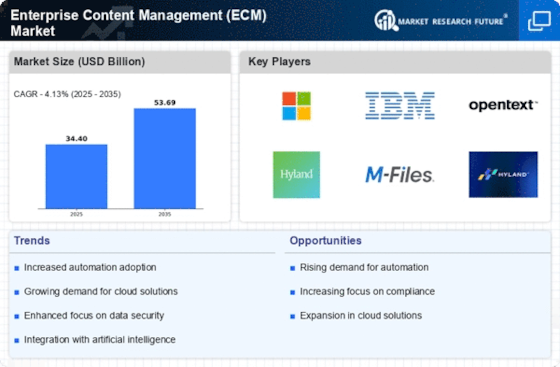

The Enterprise Content Management (ECM) Market is currently characterized by a dynamic competitive landscape, driven by the increasing need for organizations to manage vast amounts of digital content efficiently. Key players such as Microsoft (US), IBM (US), and OpenText (CA) are at the forefront, each adopting distinct strategies to enhance their market positioning. Microsoft (US) emphasizes innovation through its cloud-based solutions, integrating AI capabilities to streamline content management processes. IBM (US), on the other hand, focuses on mergers and acquisitions to bolster its ECM offerings, while OpenText (CA) is expanding its global footprint through strategic partnerships, particularly in emerging markets. Collectively, these strategies contribute to a competitive environment that is both fragmented and rapidly evolving, as companies seek to differentiate themselves through technological advancements and customer-centric solutions. In terms of business tactics, companies are increasingly localizing their operations to better serve regional markets, optimizing supply chains to enhance efficiency. The ECM market appears moderately fragmented, with a mix of established players and emerging startups vying for market share. This competitive structure allows for a diverse range of solutions, catering to various organizational needs and preferences. The influence of key players is substantial, as their strategic initiatives often set industry standards and drive innovation across the sector. In August 2025, Microsoft (US) announced the launch of its new AI-driven content management platform, which aims to enhance user experience by automating routine tasks and providing advanced analytics. This strategic move is significant as it positions Microsoft to leverage its existing cloud infrastructure while addressing the growing demand for intelligent content solutions. The integration of AI not only streamlines operations but also empowers organizations to derive actionable insights from their content, thereby enhancing decision-making processes. In September 2025, IBM (US) completed the acquisition of a leading ECM provider, which is expected to enhance its capabilities in document management and workflow automation. This acquisition is pivotal as it allows IBM to integrate advanced technologies into its existing offerings, thereby strengthening its competitive edge. By expanding its portfolio, IBM aims to provide comprehensive solutions that meet the evolving needs of businesses in a digital-first world. In July 2025, OpenText (CA) entered into a strategic partnership with a prominent cloud service provider to enhance its ECM solutions. This collaboration is likely to facilitate the development of more robust, scalable solutions that can cater to a wider audience. The partnership underscores OpenText's commitment to innovation and its strategy to leverage external expertise to enhance its product offerings, thereby positioning itself as a leader in the ECM market. As of October 2025, the ECM market is witnessing trends such as increased digitalization, a focus on sustainability, and the integration of AI technologies. These trends are reshaping the competitive landscape, as companies prioritize strategic alliances to enhance their capabilities and market reach. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is becoming increasingly evident. Moving forward, organizations that can effectively differentiate themselves through advanced technological solutions and sustainable practices are likely to thrive in this evolving market.