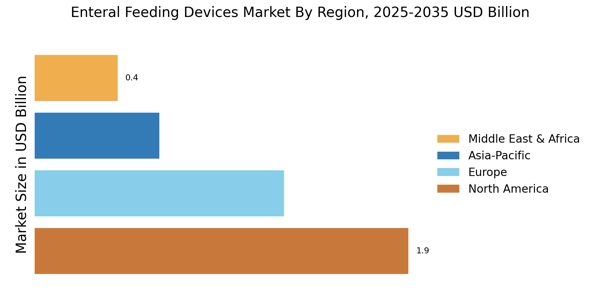

North America : Market Leader in Innovation

North America dominated the global Enteral Feeding Devices Market in 2024, reaching a market size of USD 1.9 billion. Growth in the United States enteral feeding devices market plays a major role in driving regional innovation and adoption. The growth is driven by an increasing prevalence of chronic diseases, an aging population, and advancements in technology. Regulatory support from agencies like the FDA has also catalyzed innovation and safety in product development, enhancing market demand.

The region's robust healthcare infrastructure further supports this growth trajectory. The United States is the leading country in this market, followed by Canada. Major players such as Abbott, Baxter International, and Cardinal Health dominate the competitive landscape, offering a wide range of products. The presence of these key players, along with ongoing research and development initiatives, ensures a dynamic market environment. The focus on improving patient outcomes and the integration of smart technologies are expected to drive future growth.

Europe : Emerging Market with Growth Potential

Europe is the second-largest market for enteral feeding devices, accounting for approximately 30% of the global market share. The growth is fueled by increasing awareness of nutritional support in healthcare settings, along with rising incidences of malnutrition among the elderly. Regulatory frameworks, such as the European Medical Device Regulation (MDR), are enhancing product safety and efficacy, thereby boosting market confidence and demand.

Germany and France are the leading countries in this region, with a strong presence of key players like Fresenius Kabi and B. Braun Melsungen AG. The competitive landscape is characterized by a mix of established companies and innovative startups, focusing on advanced technologies and patient-centric solutions. The emphasis on home healthcare and outpatient services is also driving the demand for enteral feeding devices, making Europe a vibrant market for growth.

Asia-Pacific : Rapidly Growing Healthcare Sector

Asia-Pacific is witnessing rapid growth in the enteral feeding devices market, holding about 15% of the global market share. Asia-Pacific is witnessing rapid growth in the enteral feeding devices market, with emerging opportunities in the India adult feeding tubes and formula market and expanding regional healthcare infrastructure supporting the india enteral feeding device market. The region's growth is driven by increasing healthcare expenditure, a rising geriatric population, and a growing awareness of nutritional support in clinical settings.

Additionally, government initiatives aimed at improving healthcare infrastructure are acting as catalysts for market expansion, making it a key area for investment and development. China and Japan are the leading countries in this market, with significant contributions from local manufacturers and international players. The competitive landscape is evolving, with companies like Medtronic and Nestle Health Science expanding their presence. The focus on innovative solutions and cost-effective products is expected to enhance market penetration, catering to the diverse needs of patients across the region.

Middle East and Africa : Untapped Market with Opportunities

The Middle East and Africa region represents a growing market for enteral feeding devices, accounting for approximately 10% of the global market share. The growth is driven by increasing healthcare investments, rising awareness of nutritional needs, and a growing prevalence of chronic diseases. Regulatory bodies are beginning to establish frameworks that support the safe use of medical devices, which is expected to further stimulate market growth in the coming years.

Countries like South Africa and the UAE are leading the market, with a mix of local and international players entering the space. The competitive landscape is characterized by a focus on affordability and accessibility, with companies looking to tailor their products to meet regional needs. The emphasis on improving healthcare services and patient outcomes is driving demand for enteral feeding devices, making this region a promising area for future growth.