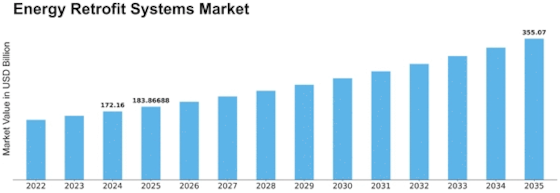

Energy Retrofit Systems Size

Energy Retrofit Systems Market Growth Projections and Opportunities

The energy retrofit systems market is impacted by overall maintainability and natural protection contemplations, which are pushed by the rising acknowledgment of the need to diminish fossil fuel byproducts and energy use. Energy retrofit systems are being used all the more much of the time by state run administrations, organizations, and buyers to further develop the energy proficiency of existing foundation and designs, featuring the market's rising accentuation on supportability.

The administrative climate altogether affects the energy retrofit systems market, as legislatures across the globe carry out thorough energy proficiency guidelines with an end goal to decrease fossil fuel byproducts and support maintainable strategic policies. This has expanded the interest in energy retrofit arrangements among ventures and organizations, which are currently committed to adjusting their items and administrations to developing ecological guidelines.

Financial variables, for example, the similar expense viability of retrofitting prior structures as opposed to recently developed energy-effective structures, move the Energy Retrofit Systems Market. Interest in energy retrofit drives is empowered by government appropriations and motivations, as well as the developing quest for financially savvy strategies to upgrade energy proficiency by organizations.

The energy retrofit systems market is significantly impacted by mechanical progressions, as clever arrangements arise to further develop execution and effectiveness. Retrofit arrangements that integrate smart advancements, information examination, and mechanization increment energy proficiency and give constant checking and control capacities. This is reliable with the patterns of Industry 4.0 and the rising execution of advanced arrangements in different businesses.

Because of cost decreases and natural advantages, the Energy Retrofit Systems Market extends at a quicker rate during times of expanded development and remodel action. On the other hand, withdrawals in the market might be impacted by financial slumps and a decrease in development.

Expanding consciousness of limited energy sources and fluctuating energy costs impact the Market, convincing ventures and organizations to put resources into energy-productive answers for a reasonable future.

Because of the rising accentuation on manageability, administrative structures, and innovative progressions — as legislatures and organizations focus on tending to environmental change and advancing energy effectiveness — the market for energy retrofit systems is expected to grow at a consistent rate.

Leave a Comment