Market Share

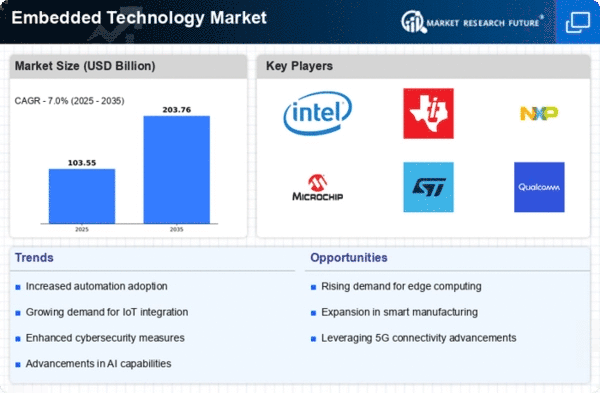

Embedded Technology Market Share Analysis

In the competitive realm of the global market for embedded technology, market share placement approaches play a pivotal part in determining the success and endurance of businesses. One prevalent method is discrimination, where firms strive to recognize their embedded solutions from competitors by proposing superior performance, unique features, or advanced functionalities. By sourcing materials efficiently, enhancing production processes, and attaining economies of level, businesses can place themselves as cost-effective selections in the market, asking price-sensitive consumers and extending their market share.

Strategic alliances and partnerships are progressively becoming prevalent market placement strategies in the embedded technology background. Businesses often seek cooperation with technology providers, industry leaders, or complementary businesses to improve their access to new markets and product offerings and leverage each other's strengths.

Another remarkable market share placement policy is customer concentration. By understanding the specialized requirements and inclinations of their target audience, businesses can customize their embedded solutions to deal with these requirements effectively. A customer-focused method not only facilitates preserving existing customers but also interests new ones through positive word-of-mouth and reputation building.

Invention is a cornerstone policy in the global market for embedded technology. Businesses that consistently invest in research and development to generate cutting-edge technologies and solutions can place themselves as industry leaders. Being at the forefront of innovation not only appeals to tech-savvy consumers but also allows businesses to set trends and standards within the market.

Market merging through mergers and acquisitions is another tactical move in the embedded technology background. By acquiring or merging with other businesses, businesses can extend their product selections, gain access to new markets, and benefit from synergies that result in cost savings.

Implementing ability and flexibility are essential strategies for embedded technology in the vigorous global market. Businesses that can quickly implement changes in technology trends, market demands, and regulatory requirements place themselves for long-term success. Geographical expansion is a policy repeatedly employed by businesses seeking to broaden their market share. By inserting new regional markets, businesses can tap into unfamiliar opportunities and spread their customer base.

In the end, the global market for embedded technology is highly competitive, and successful market share-placement strategies require a multifaceted approach. Whether through differentiation, cost leadership, strategic partnerships, customer focus, innovation, market consolidation, flexibility, geographical expansion, or effective marketing, businesses must carefully craft their strategies to align with market conditions and stake out a strong and sustainable place in this emerging background.

Leave a Comment