Elemental Fluorine Size

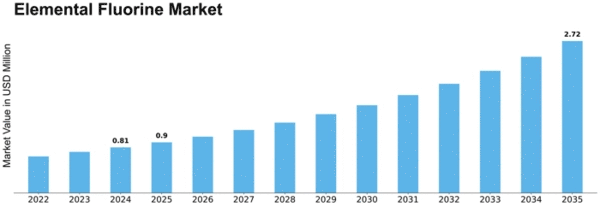

Elemental Fluorine Market Growth Projections and Opportunities

The size of the elemental fluorine market is highly influenced by numerous factors, which shape its dynamics and define its growth path. The increasing demand for fluorine in several industrial applications is one of the main drivers. Moreover, environmental awareness and sustainability are driving changes in this industry. Fluorinated products have unique characteristics that make them useful for refrigerants or batteries among other applications. Market transition towards eco-friendly substitutes is also driving the need for fertilisers hence increasing demand for fluorspar. Other clean energy technologies are depending on it.

The regulatory framework also plays a significant role shaping up the dynamics of the elemental fluorine market. Strict regulations regarding environment conservation and workplace safety influence manufacturing, use, and handling of products based on fluoride compounds. To satisfy these requirements companies must consider investments into cutting edge technologies thereby affecting how markets perform at large scale level. Equally important new applications or product approvals requiring incorporation of fluoride can lead to some means for future expansion.

Research activities have been implicated as major market factors influencing the development of Elemental Fluorine Market . They seek to identify novel uses while enhancing existing procedures which broaden adaptability and efficiency levels thus making them competitive. Advancements associated with fluoric chemistry & technology contribute significantly towards expanding markets across various industries.

Availability and prices charged for raw materials particularly fluorspar being an important source of fluorine have great impact on elemental florin market (Park et al., 2016). Any variations in supply chain or political disturbances that affect mining operations coupled with production capacity shifts leads to fluctuations in cost structure involving raw materials hence changes the dynamics of the market. Besides, production of fluorine is highly energy dependent and thus energy prices are one of the most important factors influencing overall cost structure within which elemental fluorine has to operate.

Competitive dynamics and market consolidation also shape the elemental fluorine market. Leading players, technological advances, as well as strategic alliances determine how competitive a particular market is. These may include company mergers and acquisitions or even partnerships that have an effect on production capacities, distribution channels, as well as research capabilities thereby affecting general landscape within this industry.

Leave a Comment