Increasing Urbanization

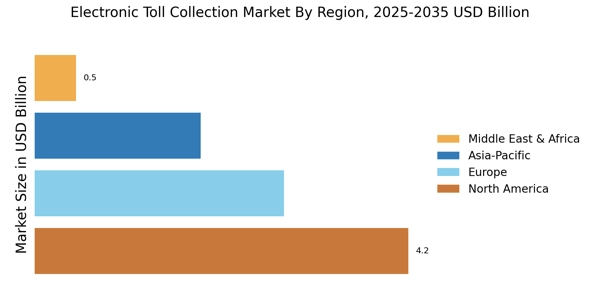

The trend of increasing urbanization appears to be a significant driver for the Electronic Toll Collection Industry. As more individuals migrate to urban areas, the demand for efficient transportation systems intensifies. Urban centers often experience heightened traffic congestion, necessitating the implementation of advanced toll collection systems to manage vehicle flow effectively. In many regions, urbanization has led to a rise in vehicle ownership, which correlates with increased toll revenues. For instance, studies indicate that urban areas with electronic tolling systems can reduce congestion by up to 30%, thereby enhancing the overall efficiency of transportation networks. This growing urban population is likely to propel the adoption of electronic toll collection solutions, as municipalities seek to modernize their infrastructure and improve traffic management.

Government Initiatives and Regulations

Government initiatives and regulations are pivotal in shaping the Electronic Toll Collection Market. Many governments are actively promoting the adoption of electronic tolling systems as part of broader transportation policies aimed at reducing congestion and improving road safety. For example, regulatory frameworks that mandate the use of electronic toll collection in new infrastructure projects can significantly boost market growth. In certain regions, government incentives for adopting smart transportation technologies have led to a marked increase in electronic tolling installations. Data suggests that regions with supportive government policies have witnessed a 25% increase in electronic toll collection usage over the past few years. Such initiatives not only facilitate smoother traffic flow but also contribute to enhanced revenue generation for public infrastructure.

Environmental Concerns and Sustainability

Environmental concerns and sustainability are becoming increasingly relevant in the Electronic Toll Collection Industry. As awareness of climate change and pollution rises, there is a growing push for transportation solutions that minimize environmental impact. Electronic toll collection systems can contribute to sustainability efforts by promoting the use of public transportation and reducing vehicle emissions through efficient traffic management. Studies indicate that implementing electronic tolling can lead to a reduction in greenhouse gas emissions by up to 20% in heavily trafficked areas. This alignment with sustainability goals is likely to attract investments from both public and private sectors, as stakeholders seek to enhance their environmental credentials. The integration of eco-friendly practices within the electronic toll collection framework may also lead to the development of innovative solutions that further support sustainable transportation initiatives.

Technological Innovations in Tolling Systems

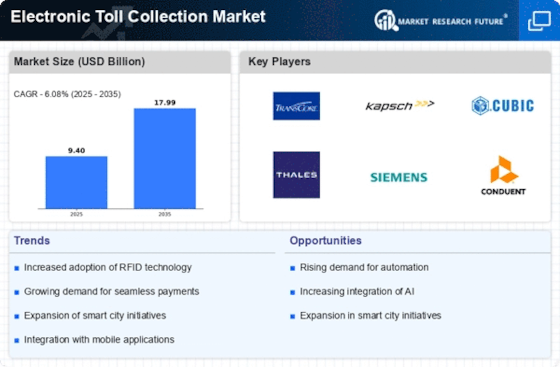

Technological innovations in tolling systems are a driving force behind the growth of the Electronic Toll Collection Industry. Advancements in technology, such as the development of RFID tags, license plate recognition, and mobile payment solutions, have revolutionized the way tolls are collected. These innovations not only enhance the efficiency of toll collection but also improve user convenience, as drivers can pass through toll booths without stopping. The market for electronic toll collection technologies is expected to witness substantial growth, with projections indicating a potential increase of 20% in adoption rates over the next few years. As technology continues to evolve, the integration of artificial intelligence and data analytics into tolling systems may further optimize operations and enhance revenue collection. This ongoing technological evolution is likely to play a crucial role in shaping the future landscape of the electronic toll collection market.

Rising Demand for Smart Transportation Solutions

The rising demand for smart transportation solutions is a crucial driver for the Electronic Toll Collection Market. As cities evolve, there is a growing emphasis on integrating technology into transportation systems to enhance efficiency and user experience. Smart transportation solutions, including electronic toll collection, are increasingly viewed as essential components of modern infrastructure. The market for smart transportation is projected to grow at a compound annual growth rate of approximately 15% over the next five years, indicating a robust appetite for innovative solutions. This trend is likely to encourage investments in electronic tolling technologies, as stakeholders recognize the potential for improved traffic management and reduced operational costs. Consequently, the integration of electronic toll collection systems into smart city initiatives is expected to gain momentum, further driving market expansion.