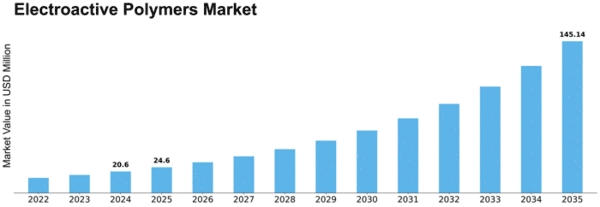

Electroactive Polymers Size

Electroactive Polymers Market Growth Projections and Opportunities

Many variables affect the Electroactive Polymers (EAP) market's dynamics and growth. The growing need for lightweight and flexible materials across sectors is a key market force. Electroactive polymers, which are lightweight and flexible, are used in robotics, healthcare, and electronics, boosting market expansion. The push toward shrinking in electronic devices is also driving EAP use because they can design tiny and finely structured components.

Technological advances shape the Electroactive Polymers market. Continuous research and development introduces new EAP formulations with improved characteristics and functions. This technological advancement is extending electroactive polymer applications and increasing market competition. Companies who invest in cutting-edge research and launch new goods get a competitive edge, influencing EAP industry growth and direction.

Global environmental concerns are driving industries like Electroactive Polymers to adopt eco-friendly solutions. EAPs lower carbon footprints by using eco-friendly materials. Demand for electroactive polymers is predicted to rise as industry adopt sustainable practices. Regulatory actions encouraging eco-friendly materials increase environmental considerations in the EAP market.

Economic conditions may affect the Electroactive Polymers market. Economic stability, disposable income, and consumer purchasing patterns affect EAP product demand. In periods of economic success, enterprises invest in new technology, driving the EAP market. In contrast, economic downturns may delay electroactive polymer adoption as industries slash costs.

Industry alliances are another important market element. Electroactive polymers are used in many industries, thus EAP manufacturers, end-users, and research institutes must collaborate to develop customized solutions and improve market reach. Partnerships may create new products, share research, and build a strong supply chain, which helps the Electroactive Polymers market grow and stabilize.

Geopolitical events and trade policy affect markets. International trade agreements, tariffs, and geopolitical concerns can affect EAP manufacturers' supply chains, production costs, and market access. Market operators must carefully handle geopolitical dynamics to avoid risks and capitalize on global possibilities."

Leave a Comment