Electrical Substation Management Size

Electrical Substation Management Market Growth Projections and Opportunities

Countries worldwide are increasingly prioritizing smart grid initiatives to address issues such as reducing transmission and distribution (T&D) losses, enhancing asset management, improving service quality, ensuring reliability, and enhancing accessibility. Within these smart grid initiatives, utilities are deploying a significant number of Intelligent Electronic Devices (IEDs) to implement advanced automation systems. However, the challenge lies in the realization of the high maintenance costs associated with these devices. Initially perceived as primarily capital-intensive, projects in the electrical sector are experiencing a shift towards higher operational costs. Utilities are now grappling with the complexities of commissioning, consistent firmware updates, and security patches required for these devices. In response, electrical substation management solutions have emerged as a key strategy to remotely manage substation secondary devices, effectively reducing operational costs.

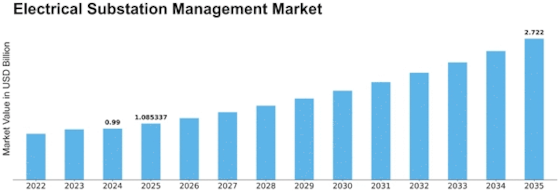

According to Market Research Future (MRFR), the global electrical substation management market has witnessed substantial growth in recent years and is projected to reach USD 1,565.45 million by 2030, exhibiting a Compound Annual Growth Rate (CAGR) of 11.1% during the forecast period from 2022 to 2030.

The global electrical substation management market is anticipated to grow at a CAGR of 11.1% during the forecast period (2022-2030). In 2021, the Asia-Pacific region led the market, capturing a share of 37.52%, followed by North America and Europe with shares of 30.1% and 24.25%, respectively. The Asia-Pacific region's dominance can be attributed to the high demand for electrical substation management in various sectors such as utilities, steelworks, oil & gas, transportation, and others, contributing to the overall market growth.

The market segmentation is based on components, applications, sources, verticals, and regions. Within the component segment, which is further divided into hardware, software, and services, software accounted for the largest market share, reaching USD 402.61 million in 2021. This segment is projected to grow at a CAGR of 11.5% during the forecast period. In terms of application, Distribution Substations held the largest market share, valued at USD 291.14 million in 2021, and is expected to grow at a CAGR of 11.4%. Among sources, Non-renewable sources dominated the market, with a market value of USD 472.81 million in 2021, and is projected to grow at a CAGR of 10.5% during the forecasted period. Finally, in the vertical segment, Utilities emerged as the leading market share holder, accounting for USD 427.39 million in 2021 and is expected to grow at a CAGR of 10.8% during the forecasted period.

The increasing adoption of electrical substation management solutions underscores the critical role they play in addressing the evolving challenges faced by utilities in managing complex networks efficiently. These solutions not only facilitate remote management of substation secondary devices but also contribute to significant cost reductions in operations. As the market continues to evolve, with a strong focus on software solutions, distribution substations, and non-renewable energy sources, the forecasted growth suggests a promising trajectory for the electrical substation management market.

The global landscape of electrical substation management is witnessing a transformative phase driven by the need for efficient, cost-effective solutions in the face of evolving challenges in the electrical sector. With smart grid initiatives gaining momentum worldwide, the demand for intelligent solutions, particularly in the form of electrical substation management, is on the rise. As the market continues to expand and innovate, the forecasted growth rates indicate a positive outlook, positioning electrical substation management as a key player in shaping the future of the electrical infrastructure sector.

Leave a Comment