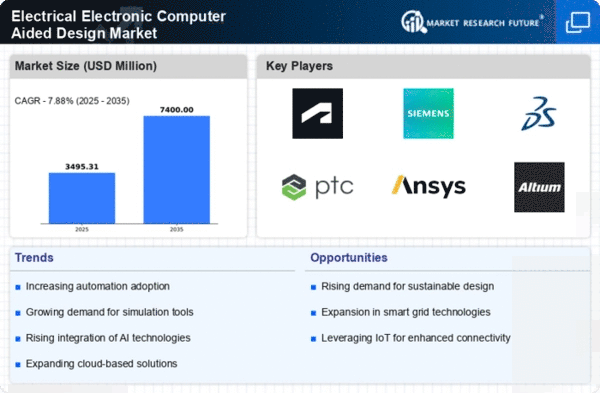

Market Share

Electrical Electronic Computer Aided Design Market Share Analysis

Electronic Design Automation (EDA) comprises various sets of software applications and algorithms crucial for the intricate design of semiconductor and electronic products. This technology relies on Electronic Computer-Aided Design (ECAD) software and incorporates the latest trends in computer and electronic technology. EDA, as an emerging technology, finds applications not only in electronic circuit design but also in diverse fields such as biomedical equipment, media & communications, and military applications.

One of the key advantages of EDA lies in its role in the design process, particularly in computer simulation. By utilizing EDA tools, designers can eliminate the stage of design verification, leading to an acceleration of the design process and a reduction in the design cycle. This not only expedites the overall process but also enhances design quality. In contrast to traditional mathematical methods, which are time-consuming and may yield less accurate results, EDA circuits leverage component models to enhance accuracy and minimize the time required for design.

The EDA system employs a database file to store model parameters and mature module designs. This approach enables users to seamlessly share data with other designers, fostering collaboration and knowledge exchange. Additionally, EDA tools play a crucial role in reducing the time required for designing complex Integrated Circuits (ICs), cutting manufacturing costs, optimizing IC design, and eliminating manufacturing errors. This comprehensive suite of capabilities makes EDA a valuable asset in the realm of electronic product design.

For designers working on Application-Specific Integrated Circuit (ASIC) logic, EDA tools offer a platform to translate logic design concepts into computer models. This functionality proves particularly beneficial when dealing with highly intricate integrated circuit applications. The tools provided by EDA enable designers to efficiently handle the complexities of ASIC logic, facilitating the implementation of advanced design ideas and contributing to the overall progress of electronic design processes.

In essence, EDA serves as a critical technology for the design and development of complex electronic products. Its applications extend across various industries, from electronics and biomedicine to media & communications and military applications. By leveraging EDA tools, designers can streamline the design process, enhance accuracy, and promote collaboration among design teams. The continued advancements in EDA contribute significantly to the evolution of electronic design, making it an indispensable element in the rapidly evolving landscape of technology and innovation.

Leave a Comment