Top Industry Leaders in the Electric Van Market

*Disclaimer: List of key companies in no particular order

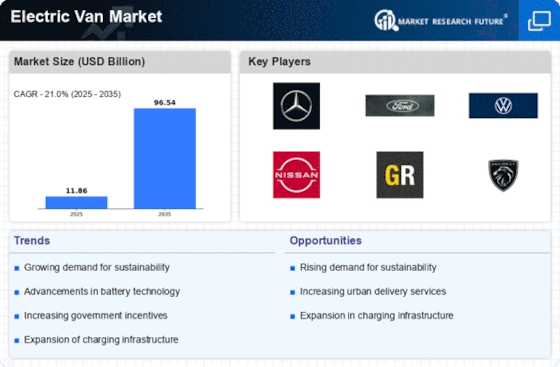

The electric van market is roaring into life, driven by sustainability goals, urban logistics demands, and government incentives. This electrifying race has attracted established auto giants, nimble startups, and even tech titans, creating a dynamic and complex competitive landscape. Let's delve into the strategies, trends, and factors shaping this market's future.

Key Players and Their Strategies:

Established Automakers: Volkswagen Group, Stellantis, and Ford are leveraging their vast production capacities and dealership networks to launch a diverse range of electric vans catering to various cargo capacities and segments. Their focus lies on building robust, cost-competitive models for mass adoption.

Agile Startups: Rivian and Arrival are disrupting the scene with innovative designs and production methods. Rivian's premium offerings target long-distance delivery fleets, while Arrival's modular platform promotes customization and rapid turnaround times.

Tech Titans: Amazon's foray with the Rivian-built Amazon Delivery Van highlights the convergence of logistics and technology. Their focus on efficiency and in-house delivery optimization could redefine the landscape.

Factors for Market Share Analysis:

Product Portfolio: The breadth and depth of offerings across van sizes, cargo capacities, and ranges play a crucial role. Players with versatile options catering to diverse customer needs gain an edge.

Charging Infrastructure: The availability and reliability of charging infrastructure directly impacts adoption. Players strategically locating charging stations near key routes and partnering with charging networks gain an advantage.

Total Cost of Ownership (TCO): Although upfront costs of electric vans might be higher, lower fuel and maintenance expenses translate to long-term savings. Players offering attractive purchase or lease options and minimizing downtime for maintenance will attract cost-conscious fleets.

Brand Reputation and Customer Service: Established brands with a proven track record and strong customer service networks hold an advantage. Startups need to build trust and demonstrate reliability to compete effectively.

New and Emerging Trends:

Software and Connectivity: Integration of telematics, route optimization, and fleet management software is becoming increasingly important. Players leveraging data analytics to maximize efficiency and uptime will stand out.

Specialization and Customization: Niche players are emerging, offering tailor-made solutions for specific industries like refrigerated vans for last-mile food delivery or vans optimized for urban deliveries.

Sustainability Focus: Beyond emissions reduction, players are focusing on using recycled materials, minimizing waste in production, and offering second-life battery solutions, aligning with evolving sustainability goals.

Overall Competitive Scenario:

The electric van market is witnessing fierce competition, with players employing diverse strategies to gain market share. Established automakers are leveraging their existing strengths, while nimble startups and tech giants are injecting innovation and disrupting traditional models. The focus on TCO, charging infrastructure, and sustainability will be key differentiators. Players who adapt to evolving customer needs, embrace technological advancements, and prioritize a holistic value proposition will thrive in this electrifying race.

With the projected exponential growth of the electric van market, the competition is expected to intensify further. Consolidation through mergers and acquisitions is a possibility, along with the emergence of new players and even more innovative solutions. The coming years will witness a battle for dominance, powered by technology, sustainability, and a relentless pursuit of customer satisfaction. The electric van market promises to be a thrilling ride, and only time will tell who will charge ahead and claim the pole position.

Industry Developments and Latest Updates:

Tesla Inc:

- December 15, 2023: Tesla announces plans to increase production of its Cybertruck electric pickup truck, with deliveries slated to begin in mid-2024. The Cybertruck is expected to have cargo space comparable to a full-size van, making it an attractive option for commercial fleets. (Source: Electrek)

Mercedes-Benz Group AG:

- October 26, 2023: Mercedes-Benz unveils the eSprinter, a fully electric version of its popular Sprinter van. The eSprinter boasts a range of up to 151 miles and is available in various cargo configurations. (Source: Mercedes-Benz press release)

BYD Company Ltd:

- December 22, 2023: BYD delivers its 10,000th T3 electric delivery van in Europe, solidifying its position as a leading player in the commercial EV market. The T3 offers a spacious cargo area and a range of up to 186 miles. (Source: BYD press release)

General Motors:

- October 24, 2023: GM announces plans to invest $2 billion in its BrightDrop electric van and delivery technology startup. The investment will support the development of new BrightDrop models and expansion into new markets. (Source: Reuters)

Hyundai Motor Company: Hyundai recently launched the Staria, a fuel cell electric van offering extended range and fast refueling times. However, the Staria is currently only available in limited markets. (Source: Hyundai press release)

Honda Motor Company Ltd.: Honda is developing the eVan, a small electric van set for launch in Japan in 2024. The eVan targets commercial and personal use with a range of up to 124 miles. (Source: Nikkei Asian Review)

Top Companies in the Electric Van industry includes,

Tesla Inc

Mercedes-Benz Group AG

BYD Company Ltd

General Motors

Toyota Motor Corporation

Hyundai Motor Company

Honda Motor Company Ltd.

Nissan Motor Co. ltd

Volkswagen AG

Stellantis N.V., and others.