Market Analysis

In-depth Analysis of Education PC Market Industry Landscape

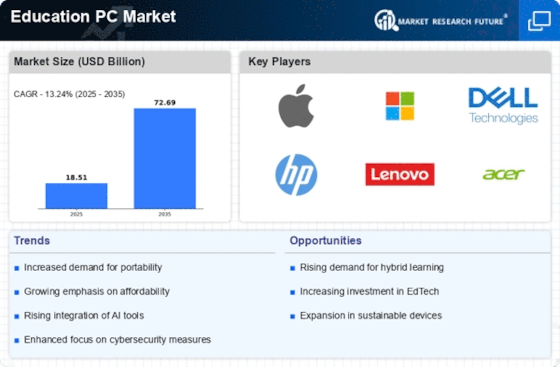

The education PC marketplace is undergoing dynamic adjustments, stimulated by evolving coaching techniques, technological advancements, and the increasing integration of digital gear in academic settings. As lecture rooms transition from traditional coaching models to greater interactive and digitally driven methods, the demand for education PCs has witnessed an exquisite surge. One of the primary drivers shaping marketplace dynamics is the global shift in the direction of digital getting to know. Educational establishments are investing in PCs to facilitate online learning, collaborative projects, and customized coaching. This demand for virtual equipment has caused the development of schooling-unique PCs with functions catering to the specific wishes of college students and educators. The market dynamics of education PCs are also prompted by using converting instructional paradigms and pedagogical strategies. The adoption of blended getting-to-know, far-flung training, and interactive coaching techniques has brought on the need for flexible PCs that may support numerous instructional techniques. Education PCs with touchscreens, convertible designs, and stylus compatibility are gaining traction, reflecting the demand for devices that facilitate dynamic and tasty getting-to-know experiences. Manufacturers adapt to those changes by designing education PCs that align with evolving teaching methodologies, influencing marketplace dynamics. The international market is similarly fashioned by using economic elements, including price range constraints and the entire fee of possession for academic establishments. While the demand for technologically advanced education PCs is high, faculties and universities often function within restrained budgets. Manufacturers must stabilize the inclusion of current capabilities with affordability to make their merchandise available to a wide variety of instructional establishments. Economic considerations affect market dynamics, riding producers to optimize expenses without compromising the niceness and functionality of educational PCs. Regulatory standards and academic rules also affect the education PC marketplace dynamics. Governments and educational authorities set tips for era use in lecture rooms, emphasizing factors along with data safety, accessibility, and compliance with instructional requirements. Manufacturers must align their products with those policies to benefit recognition within the schooling region. This regulatory panorama shapes market dynamics as producers work to make sure that their education PCs meet the criteria set through instructional government. Technological advancements, especially in processing power, connectivity, and battery existence, make contributions appreciably to the market dynamics of education PCs. The integration of effective processors enables smoother multitasking and supports aid-intensive educational programs. Improved connectivity functions facilitate seamless communication among gadgets, while extended battery life ensures that education PCs can face up to the needs of a full day of study room use. Manufacturers always invest in research and development to include brand new technologies, influencing market dynamics and putting new benchmarks for overall performance and reliability in education PCs.

Leave a Comment