Edible Packaging Size

Edible Packaging Market Growth Projections and Opportunities

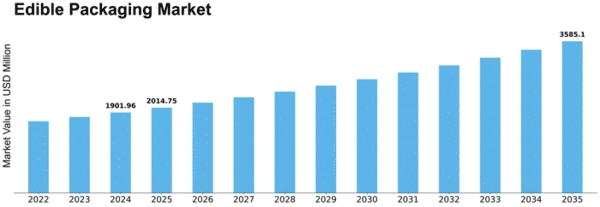

The value of the Edible Packaging Market was USD 1.5 Billion in 2022, and it is projected to grow from USD 1.6 Billion in 2023 to USD 2.709 Billion by 2032 at a CAGR of 6.79%. The popularity of the Edible Packaging Market has been on the increase due to a number of key market forces that are influencing consumer preferences and changing industrial dynamics. One major factor contributing to this trend is the increasing global awareness of environmental sustainability. Also, the Edible Packaging Market is driven by rising demand for convenience and on-the-go food options. Since consumers have busy lifestyles and prefer hassle-free consumption, there has been an increasing preference for packaging that is eco-friendly and practically useful. This need is met by edible packaging, which provides a convenient outer layer that can be eaten along with various food products, thus eliminating separate disposal and giving rise to a more unified customer experience. Moreover, another important issue propelling growth in the Edible Packaging Market is its focus on food safety and preservation. Sometimes, edible packaging materials may possess natural antimicrobial properties that lengthen perishable items' shelf life. Furthermore, innovation within the food industry has also become one of the major influences behind the growth trends of the Edible Packaging Market. Companies are always looking to distinguish their products from others and stay ahead in a competitive market; hence, the adoption of this type of packaging helps them make unique, creative product offerings. This kind of creativity not only attracts customers but also enhances general market attractiveness, thereby creating an environment where continuous improvement takes place by adapting to varying customer tastes. Government regulations and initiatives promoting sustainable practices are playing a pivotal role in shaping the Edible Packaging Market. Numerous countries have put in place strict policies aimed at reducing single-use plastic bags while promoting other environmentally friendly packaging alternatives. To comply with such regulations, many businesses are opting for eatable wrappers. Furthermore, the industry is experiencing growth in collaborations and partnerships. With the realization of edible packaging's potential, there has been an increased number of collaborations between companies and other businesses as well as research institutions. These relationships aim to speed up invention, improve the quality of eatable packaging materials, and increase their range of use. Through such collaboration, the entire industry benefits from shared knowledge while sustainable packaging solutions are developed rapidly.

Leave a Comment