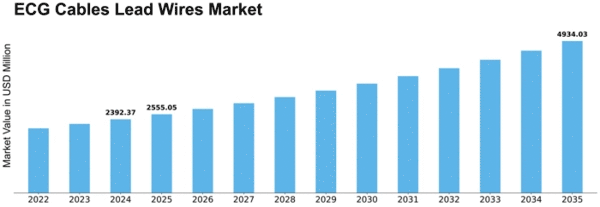

Market Growth Projections

The Global ECG Cables and Lead Wires Market Industry is projected to experience substantial growth in the coming years. With a market value of 2.39 USD Billion in 2024, it is expected to reach 4.93 USD Billion by 2035, reflecting a robust compound annual growth rate of 6.81% from 2025 to 2035. This growth trajectory indicates a rising demand for ECG monitoring solutions, driven by factors such as technological advancements, increasing healthcare expenditure, and the growing prevalence of cardiovascular diseases. The market's expansion is indicative of the critical role that ECG cables and lead wires play in modern healthcare systems.

Growing Geriatric Population

The global increase in the geriatric population is a crucial driver for the Global ECG Cables and Lead Wires Market Industry. Older adults are more susceptible to cardiovascular diseases, necessitating regular monitoring and diagnostic assessments. As the population aged 65 and above continues to rise, healthcare systems are adapting to meet the growing demand for ECG monitoring solutions. This demographic shift is expected to contribute to the market's growth, with projections indicating a market value of 4.93 USD Billion by 2035. The need for specialized ECG cables and lead wires tailored for elderly patients further emphasizes the importance of this market segment.

Regulatory Support and Standards

Regulatory support and the establishment of standards for ECG devices play a pivotal role in shaping the Global ECG Cables and Lead Wires Market Industry. Governments and health organizations are implementing stringent regulations to ensure the safety and efficacy of medical devices, including ECG cables and lead wires. Compliance with these regulations not only enhances product quality but also fosters consumer confidence in ECG monitoring solutions. As manufacturers align their products with regulatory standards, the market is likely to witness increased adoption of advanced ECG technologies, further driving growth in this sector.

Increasing Healthcare Expenditure

Rising healthcare expenditure across various regions is a significant factor influencing the Global ECG Cables and Lead Wires Market Industry. Governments and private sectors are investing heavily in healthcare infrastructure, leading to enhanced access to advanced medical technologies. This trend is particularly evident in developing countries, where improved healthcare funding is facilitating the acquisition of modern ECG equipment. As healthcare budgets expand, the demand for high-quality ECG cables and lead wires is expected to grow. The anticipated compound annual growth rate of 6.81% from 2025 to 2035 reflects the market's potential as healthcare systems prioritize cardiac care.

Technological Advancements in ECG Devices

Technological innovations in ECG devices significantly contribute to the growth of the Global ECG Cables and Lead Wires Market Industry. The introduction of wireless ECG monitoring systems and improved lead wire designs enhances the accuracy and convenience of cardiac monitoring. These advancements facilitate real-time data transmission, allowing healthcare professionals to make timely decisions. As the market evolves, the integration of artificial intelligence and machine learning into ECG devices is anticipated to further enhance diagnostic capabilities. This technological evolution not only improves patient care but also expands the market potential, as healthcare facilities increasingly adopt these advanced solutions.

Rising Prevalence of Cardiovascular Diseases

The increasing incidence of cardiovascular diseases globally drives the demand for ECG cables and lead wires. As per health statistics, cardiovascular diseases remain a leading cause of mortality worldwide, necessitating effective monitoring solutions. The Global ECG Cables and Lead Wires Market Industry is poised to benefit from this trend, as healthcare providers seek advanced diagnostic tools to manage patient care. The market is projected to reach 2.39 USD Billion in 2024, reflecting a growing need for reliable and efficient ECG monitoring solutions. This trend underscores the importance of ECG cables and lead wires in enhancing patient outcomes and reducing healthcare costs.

Leave a Comment