Research Methodology on Earphone - Headphone Market

Introduction

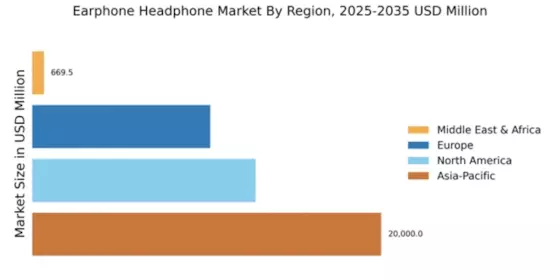

The global earphone and headphone market is projected to grow at a staggering CAGR by 2030. Growing technology, increasing disposable income, and consumers' changing preference for convenience in listening to audio are the major drivers of market growth. The market study on the Global Earphone and Headphone Market aims to provide an all-inclusive coverage of the market across all crucial characteristics. Moreover, the chapter-wise division of the market ensures an accurate and precise study of the market trends, providing an in-depth analysis of the industry.

Research Methodology

The research method used in this research report is quantitative, descriptive, and causal research. Quantitative research involves the collection of data and information through surveys, observations, and experiments. Descriptive research involves the analysis of the collected data and information to understand the trends and patterns in the global earphone and headphone market. Causal research is used to identify the relationships between the independent and dependent variables in the market.

Data Sources

The data used for this research report is sourced from secondary sources such as the World Bank database, the International Monetary Fund database, the World Economic Forum database, the US Federal Reserve database, the OECD database, and the Eurostat database. Additionally, the data is validated by industry experts and stakeholders.

Sampling Frame

The sampling frame for this research report includes all the companies and factories, distributors, dealers and suppliers of earphones and headphones, market analysts, economic analysts, and other business executives from the global earphone and headphone industry. The sampling frame is identified by conducting a thorough market study of both primary and secondary sources.

Sampling Method

The sampling method used in this research report is random sampling in which a pre-defined number of respondents are randomly selected from the pre-defined sampling frame. The sample size is chosen to be sufficient enough to obtain results with maximum accuracy.

Data Collection Methods

The data is collected using both primary and secondary sources. Primary data is collected through interviews and surveys of industry experts, stakeholders, and manufacturers of earphones and headphones. Secondary data is sourced from published reports, market studies, and market reports.

Data Analysis

The collected data is analyzed using both qualitative and quantitative methods. Qualitative data analysis is used to determine the market trends and patterns in the global earphone and headphone market and the causal relationships between the independent and dependent variables. Quantitative data analysis is used to measure the growth of the market in terms of value, volume and market share and to analyze the market dynamics.

Validity and Reliability

The validity of the research findings is tested through several internal and external tests. The internal tests include cross-checking data and documents, examining the research methodology and surveys, and interviewing industry experts. The external tests include examining the industry reports, data from third-party sources, and external feedback. The data obtained are also compared with the industry standards and accepted concepts. Additionally, the reliability of the findings is tested by conducting multiple tests of the same data across different regions.

Ethical Consideration

All the ethical considerations are taken into account while conducting the research and in the preparation of the report. The data is collected fairly and without any bias. The collected data is used solely for the research and is kept strictly confidential.