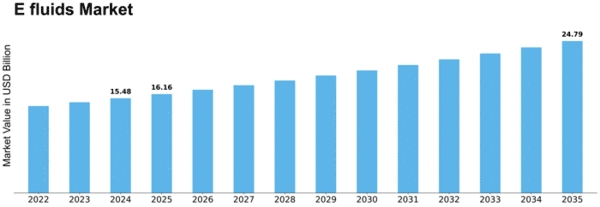

E Fluids Size

E fluids Market Growth Projections and Opportunities

The E-fluids Market is influenced by various factors that contribute to its dynamics and growth. A primary driver is the increasing popularity of electronic cigarettes (e-cigarettes) and vaping devices. E-fluids, also known as e-liquids or vape juices, are crucial components of these devices, providing the flavors and nicotine solutions that users inhale. The growing acceptance of vaping as an alternative to traditional tobacco smoking propels the demand for diverse and innovative e-fluid products.

Raw material availability and pricing are critical factors affecting the e-fluids market. The primary ingredients in e-fluids include propylene glycol, vegetable glycerin, flavorings, and nicotine. Fluctuations in the prices of these raw materials, influenced by factors such as supply-chain disruptions and regulatory changes, impact the overall production cost of e-fluids, subsequently affecting market prices. The availability of high-quality and safe raw materials is essential to ensure the integrity and safety of e-fluid products.

Regulatory landscape and government policies play a significant role in shaping the e-fluids market. The industry faces continuous scrutiny and evolving regulations related to product safety, labeling, and marketing practices. Compliance with these regulations is essential for companies to ensure the quality and safety of their e-fluid products and maintain consumer trust. Changes in regulatory frameworks can impact the market dynamics and require companies to adapt their formulations and marketing strategies.

Technological advancements in e-fluid manufacturing processes contribute to market growth. Innovations in flavor extraction, nicotine delivery systems, and packaging technologies lead to the development of enhanced and differentiated e-fluid products. Continuous research and development in the industry drive advancements, expanding the range of flavors and formulations available in the market and influencing consumer preferences.

Consumer preferences for diverse and customized flavors influence the e-fluids market. The availability of a wide range of flavors, including fruit, dessert, menthol, and tobacco, caters to varying tastes and preferences among users. Companies in the e-fluids sector need to stay attuned to changing flavor trends and offer innovative and high-quality products to meet consumer demands.

Global economic conditions and trade policies also play a role in shaping the e-fluids market. Changes in international trade agreements, tariffs, and geopolitical factors can impact the supply chain, affecting both producers and consumers. Companies in the market must navigate these global economic dynamics to ensure stability in their operations and explore new opportunities in emerging markets.

Public health awareness and safety concerns influence the e-fluids market. As discussions around the potential health risks associated with vaping continue, consumer perceptions and attitudes toward e-fluids may shift. Companies that prioritize transparency, product safety, and responsible marketing practices can build trust and credibility in the market.

Weather conditions and climate considerations may impact the e-fluids market, especially in regions where temperature and humidity levels can affect the storage and quality of e-fluid products. Companies need to consider these environmental factors to ensure the stability and integrity of their products during production, transportation, and storage.

Leave a Comment