Research Methodology on Dyes Pigments Market

1.0 Introduction

The research methodology used to analyze the Global Dyes and Pigments Market will focus on qualitative and quantitative analysis through primary and secondary market research techniques. In this report, we will analyze the market size, trends, market segments, growth prospects, vendor landscape, competitive dynamics, key players, and regional outlook of the market. This report covers the factors impacting the supply and demand of dyes and pigments in the market as well as their pricing structure. Further, this report will also offer insight into the industry value chain analysis, industry competition matrix, and the investment scenario related to the market.

2.0 Research Approach

As part of the research for the Global Dyes and Pigments Market, secondary research was conducted through sources including but not limited to company websites, financial reports, government policies, industry associations, and databases. The primary research involved interviews and direct communications with key industry personnel and opinion leaders, such as CEOs, directors, and marketing executives. Both primary and secondary research methods have been used to gain insights into consumer behaviour and the macroeconomic factors that will influence the growth of the market.

3.0 Scope of the Study

The scope of this report is focused on the penetration and adoption of dyes and pigments within the market and the various industry segments in which they are used. The study is focused on the current industry trends and future market potentials.

This report also offers essential data on the cost structure, pricing trend, and pricing structure analysis of the global dyes and pigments market. The report also covers the various opportunities in the market and the strategies that the companies are undertaking to gain maximum consumer adoption.

The analyses and insights in the report are informed by a distinctive mix of primary and secondary research sources. The primary research included in-depth interviews and direct communication with key industry personnel and opinion leaders. Secondary research involved referring to industry associations, press releases, investor presentations, company websites, databases, and renowned paid sources for market data.

4.0 Data Collection

We gathered market research and data from a wide variety of resources and compiled them in the report. Sources used for secondary research included:

- Trade journals

- Company websites

- Databases and reports from relevant industries

- Annual reports

- Government publications

- Industry associations

- Corporate and investor presentations

- Trade magazines

We conducted primary research with over 20 stakeholders including industry experts, market observers, and opinion leaders to better understand the changing dynamics of the Global Dyes and Pigments Market. We also conducted interviews with key opinion leaders. Through these interviews, we were able to identify the latest trends and their impact on the market.

5.0 Market Estimation

Estimation of the Global Dyes and Pigments Market was done using the top-down and bottom-up approaches. We also used the triangulation approach for clarifying and validating the data gathered through both primary and secondary research. Secondary research was used to identify the top industry players, the overall size of the market, and the market share held by the top players. The bottom-up approach was used to confirm the overall market size. The top-down approach was used for estimating the size of the individual categories and sub-categories.

6.0 Primary Research

Primary research was conducted to gain a better understanding of the industry trends, market factors, and competitive scenarios. The primary research included interviews, surveys, and discussions with the major industry participants. Industries experts, opinion leaders, and industry participants were interviewed for the data validation process.

7.0 Finalization of the Report

The finalization of the report was done with the help of the triangulation method. This method combines primary and secondary research and focuses on determining the accuracy of the data gathered. The triangulation method uses three different methods to ensure the accuracy of the market estimates and to identify any discrepancies in the market data.

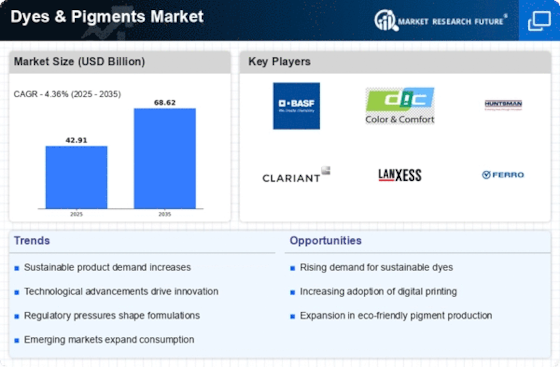

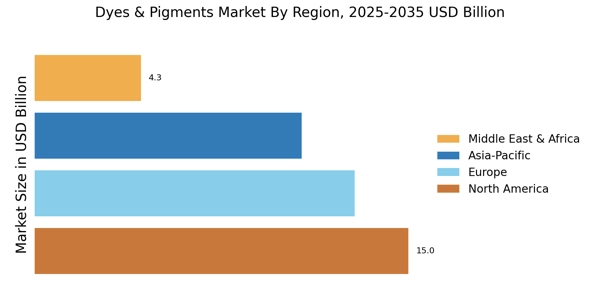

We conducted an in-depth analysis of the Global Dyes and Pigments Market in order to assess the current and future market trends. Our analysts use advanced primary and secondary research techniques and tools to compile comprehensive market reports. This report provides a detailed market analysis, focusing on the key industry players, market trends, market size, drivers, restraints, and opportunities.