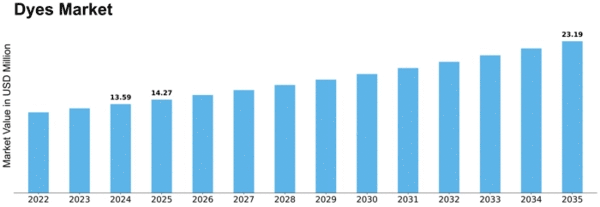

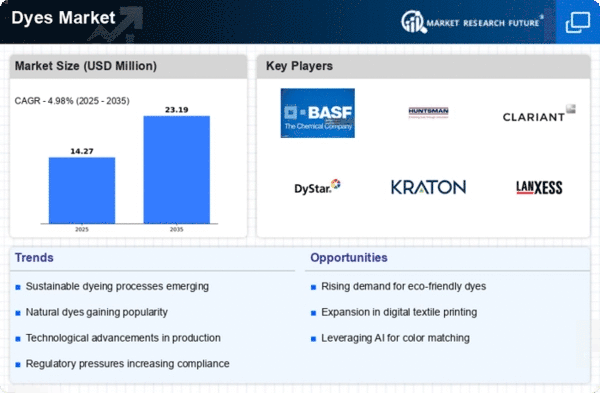

Dyes Size

Dyes Market Growth Projections and Opportunities

The dyes market is a dynamic and competitive landscape, driven by various industries such as textiles, paints and coatings, plastics, and printing inks. Market share positioning strategies play a crucial role in determining the success and growth of companies operating in the dyes sector. Here are key strategies employed by players to enhance their market share: Product Portfolio Diversification: Companies aim to expand their market share by offering a diverse range of dyes catering to different applications and industries. This diversification helps capture a broader customer base and respond to changing market demands. Technological Innovation: Staying at the forefront of technological advancements in dye manufacturing is a key strategy. Companies invest in research and development to introduce innovative and high-performance dyes, gaining a competitive edge and increasing their market share. Focus on Sustainable and Eco-Friendly Dyes: With the growing emphasis on sustainability, companies strategically position themselves by developing and promoting eco-friendly and sustainable dye options. This aligns with market trends and regulatory preferences, appealing to environmentally conscious customers. Geographic Expansion: Expanding market presence geographically is a common strategy. Companies strategically enter new regions or strengthen their distribution networks to reach untapped markets, thereby increasing their market share on a global scale. Strategic Partnerships and Collaborations: Forming strategic partnerships with other industry players, suppliers, or research institutions is a collaborative strategy to enhance market share. This allows for shared resources, joint research efforts, and increased market reach. Customization and Tailored Solutions: Offering customized dye solutions to meet specific customer requirements is a strategy adopted by some companies. This approach helps in building long-term relationships with clients and gaining a competitive advantage in niche markets. Cost Leadership: Some companies focus on becoming cost leaders in the market by optimizing production processes, improving efficiency, and managing costs effectively. This strategy enables them to offer competitive pricing and capture a larger market share. Branding and Marketing Strategies: Building a strong brand presence through effective marketing strategies is vital. Companies invest in brand building, advertising, and promotional activities to create brand recognition and loyalty, influencing market share positively. Regulatory Compliance and Certification: Ensuring that dyes meet regulatory standards and obtaining relevant certifications is a strategic move. Compliance with international standards enhances credibility, builds trust among customers, and positively impacts market share. Mergers and Acquisitions: Mergers and acquisitions are strategic moves employed to consolidate market share. Companies strategically acquire or merge with other entities to gain access to new technologies, customer bases, and distribution channels, fostering growth and market dominance. Customer Relationship Management: Building strong customer relationships is a pivotal aspect of market share positioning. Companies invest in customer service, feedback mechanisms, and after-sales support to enhance customer satisfaction and loyalty, ultimately impacting market share positively. Continuous Improvement and Quality Assurance: Implementing continuous improvement initiatives and maintaining high-quality standards are strategic imperatives. This ensures customer satisfaction, builds a reputation for reliability, and contributes to the long-term positioning of a company in the market. 13. Monitoring Competitor Strategies: Keeping a vigilant eye on competitor activities is crucial for staying competitive. Understanding competitor strategies helps companies adjust their own approaches, identify market gaps, and capitalize on emerging opportunities to maintain or enhance market share.

Leave a Comment