Dupuytren S Contracture Size

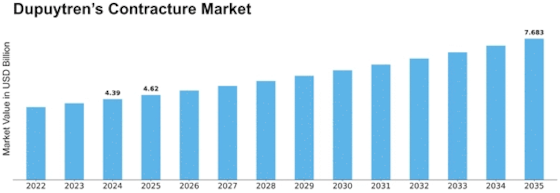

Dupuytren’s Contracture Market Growth Projections and Opportunities

Advancements in diagnostic techniques, including physical assessment, imaging modalities like ultrasound, and biochemical markers, work with careful diagnosis and assessment of Dupuytren's contracture. Further developed diagnostic capabilities impact market interest for early mediation and designated treatment approaches. Assessing the assortment and adequacy of treatment options for Dupuytren's contracture, including non-surgical interventions like collagenase injections, needle aponeurotomy, and surgical procedures like fasciectomy, is critical. Market dynamics are affected by factors such as treatment effectiveness, safety profiles, and patient preferences, shaping the reception of specific treatment modalities. The quality and accessibility of healthcare infrastructure, including hand surgery centers, recovery facilities, and essential consideration settings, impact patient access to Dupuytren's contracture diagnosis and treatment. Market dynamics are shaped by factors such as healthcare spending, insurance inclusion, and infrastructure improvement initiatives aimed at working on persistent outcomes. Monetary factors, including healthcare use and reimbursement policies, influence the reasonableness and accessibility of Dupuytren's contracture treatments. Market dynamics are affected by factors such as government healthcare spending, confidential insurance inclusion, and personal expenses for patients seeking Dupuytren's contracture treatment. Investigating potential growth opportunities in developing markets, incorporating regions with high predominance rates of Dupuytren's contracture and developing healthcare infrastructure, is essential for market expansion strategies. Factors such as administrative challenges, market access barriers, and social considerations influence market entrance and item reception in these regions. Checking mechanical innovations close by surgery, including insignificantly invasive techniques, novel biomaterials, and tissue designing approaches, provides insights into future market trends and opportunities for Dupuytren's contracture treatment. Advances in innovation drive the improvement of more personalized and powerful treatment options, working on tolerant outcomes and extending market reach.

Leave a Comment