Expansion of Mining Activities

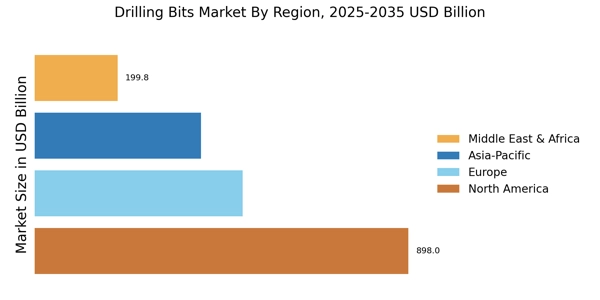

The Drilling Bits Market is witnessing growth due to the expansion of mining activities across various sectors. The increasing demand for minerals and metals, driven by industrial applications and technological advancements, is propelling exploration and extraction efforts. Mining companies are investing in advanced drilling technologies to enhance their operational efficiency and reduce costs. The global mining industry is projected to grow significantly, with a focus on discovering new mineral deposits. This trend is expected to drive the demand for specialized drilling bits that can effectively penetrate diverse geological formations. As mining operations expand, the Drilling Bits Market is likely to experience a corresponding increase in demand for innovative and high-performance drilling solutions.

Rising Demand for Energy Resources

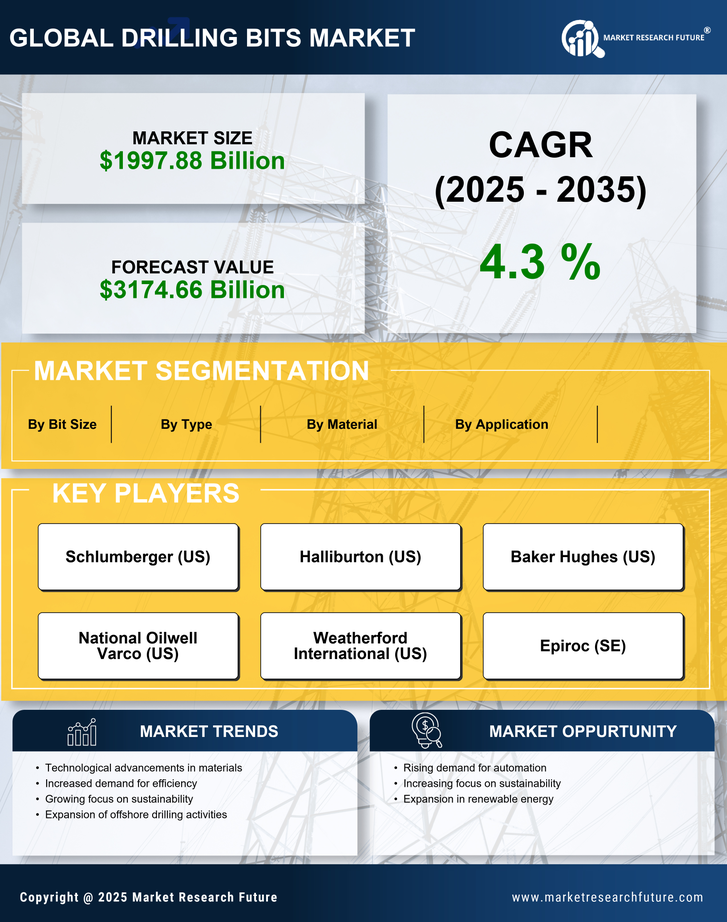

The Drilling Bits Market is experiencing a surge in demand driven by the increasing need for energy resources. As countries strive to meet their energy requirements, exploration and production activities in oil and gas sectors are intensifying. According to recent data, the global energy consumption is projected to rise by approximately 30% by 2040, necessitating enhanced drilling operations. This trend is likely to propel the demand for advanced drilling bits, which are essential for efficient extraction processes. Furthermore, the shift towards unconventional resources, such as shale gas and tight oil, is expected to further stimulate the Drilling Bits Market, as these resources require specialized drilling technologies to optimize recovery rates.

Technological Innovations in Drilling

Technological advancements play a pivotal role in shaping the Drilling Bits Market. Innovations such as polycrystalline diamond compact (PDC) bits and roller cone bits are revolutionizing drilling efficiency and effectiveness. These advanced drilling bits are designed to withstand extreme conditions, thereby enhancing performance and reducing operational costs. The introduction of smart drilling technologies, which integrate real-time data analytics, is also transforming drilling operations. This integration allows for better decision-making and optimization of drilling parameters, leading to increased productivity. As companies continue to invest in research and development, the Drilling Bits Market is likely to witness a proliferation of innovative products that cater to diverse drilling needs.

Growing Focus on Environmental Sustainability

The Drilling Bits Market is increasingly influenced by the growing emphasis on environmental sustainability. As regulatory frameworks tighten and public awareness of environmental issues rises, companies are compelled to adopt eco-friendly drilling practices. This shift is leading to the development of drilling bits that minimize environmental impact, such as those designed for reduced noise and lower emissions. Furthermore, the transition towards renewable energy sources is prompting the exploration of geothermal and other sustainable resources, which require specialized drilling technologies. The Drilling Bits Market is likely to evolve in response to these sustainability trends, with manufacturers focusing on creating products that align with environmental standards and promote responsible resource extraction.

Increased Investment in Infrastructure Development

The Drilling Bits Market is benefiting from heightened investments in infrastructure development across various regions. Governments and private entities are allocating substantial funds towards the construction of roads, bridges, and energy facilities, which necessitate extensive drilling activities. For instance, the construction of renewable energy projects, such as wind and solar farms, requires specialized drilling techniques to install foundations and support structures. This trend is expected to drive the demand for high-performance drilling bits that can operate efficiently in diverse geological conditions. Additionally, the ongoing urbanization and industrialization efforts in emerging economies are likely to further bolster the Drilling Bits Market, as these initiatives require robust drilling solutions.