Dolce Gusto Market Summary

As per Market Research Future analysis, the Dolce Gusto Market Size was estimated at 3.66 USD Billion in 2024. The Dolce Gusto industry is projected to grow from 3.904 USD Billion in 2025 to 7.446 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 6.67% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Dolce Gusto market is experiencing a dynamic shift towards convenience and sustainability, driven by evolving consumer preferences.

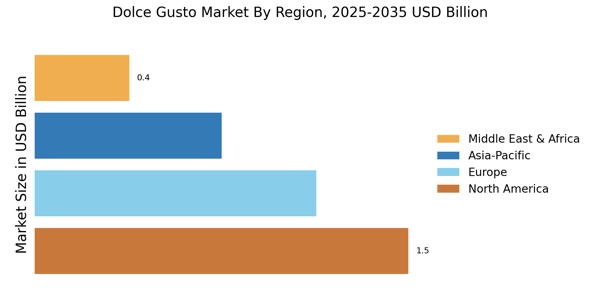

- The North American market remains the largest, reflecting a robust coffee culture that emphasizes convenience.

- In the Asia-Pacific region, the Dolce Gusto market is the fastest-growing, fueled by increasing urbanization and changing lifestyles.

- The machines segment continues to dominate the market, while the capsules segment is witnessing rapid growth due to consumer demand for variety.

- Key market drivers include the rising coffee culture and sustainability initiatives, which are shaping product offerings and consumer choices.

Market Size & Forecast

| 2024 Market Size | 3.66 (USD Billion) |

| 2035 Market Size | 7.446 (USD Billion) |

| CAGR (2025 - 2035) | 6.67% |

Major Players

Nestle (CH), Keurig Dr Pepper (US), Unilever (GB), Peet's Coffee (US), Jacobs Douwe Egberts (NL), Lavazza (IT), Tchibo (DE), Starbucks (US), Café Royal (CH)