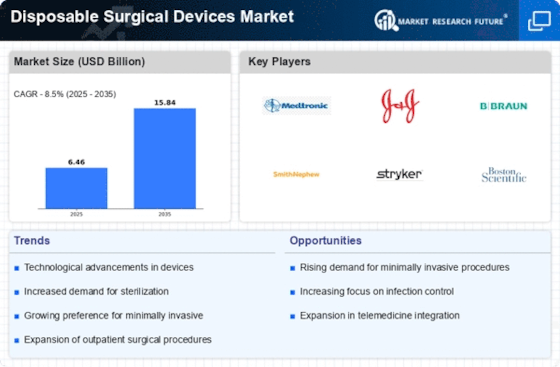

Market Share

Disposable Surgical Devices Market Share Analysis

The Disposable Surgical Devices market, a critical sector within the broader healthcare industry, is marked by intense competition, leading companies to deploy various market share positioning strategies. In this dynamic landscape, effective strategies are instrumental in determining the success and sustainability of businesses operating in the Disposable Surgical Devices sector. A prominent strategy involves product innovation and differentiation, where companies strive to offer unique and advanced disposable surgical devices. This approach allows businesses to meet the evolving needs of healthcare professionals, ensuring that their products stand out in terms of safety, efficiency, and ease of use. For instance, disposable surgical devices with enhanced ergonomic designs or those incorporating the latest materials and manufacturing technologies gain favor among healthcare practitioners, contributing to market differentiation.

Pricing strategies play a crucial role in market share positioning within the Disposable Surgical Devices market. Companies often choose between premium pricing and cost leadership, depending on their target market and positioning. Some companies opt for a premium pricing strategy, positioning their disposable surgical devices as high-quality, technologically advanced solutions with added features. This appeals to healthcare facilities and professionals who prioritize quality and are willing to invest in cutting-edge products. Conversely, a cost leadership strategy involves providing competitively priced disposable surgical devices without compromising on essential quality standards. This attracts budget-conscious customers, fostering a competitive advantage in price-sensitive market segments.

Strategic partnerships and collaborations are key drivers in market share positioning for Disposable Surgical Devices. Companies may form alliances with healthcare institutions, surgical centers, or distribution partners to expand their market reach and enhance their distribution networks. Collaborations not only amplify the visibility of disposable surgical devices but also provide opportunities for shared resources, knowledge exchange, and mutual growth, contributing to a stronger market position.

Market segmentation is another crucial strategy employed by companies to effectively target specific customer segments. Recognizing the diverse needs of healthcare providers, surgical specialties, and geographic regions, businesses tailor their disposable surgical devices to address the unique requirements of each segment. By understanding and responding to the distinct challenges faced by various end-users, companies can refine their marketing efforts and product offerings, thereby enhancing their position within the market.

Customer-centric approaches, including comprehensive after-sales support and training, significantly impact market share positioning. Companies that prioritize customer satisfaction by offering training programs, educational resources, and prompt technical support can build strong relationships with their customers. A satisfied customer base is more likely to remain loyal and act as a positive advocate for the brand, influencing the company's market share over the long term.

Leave a Comment