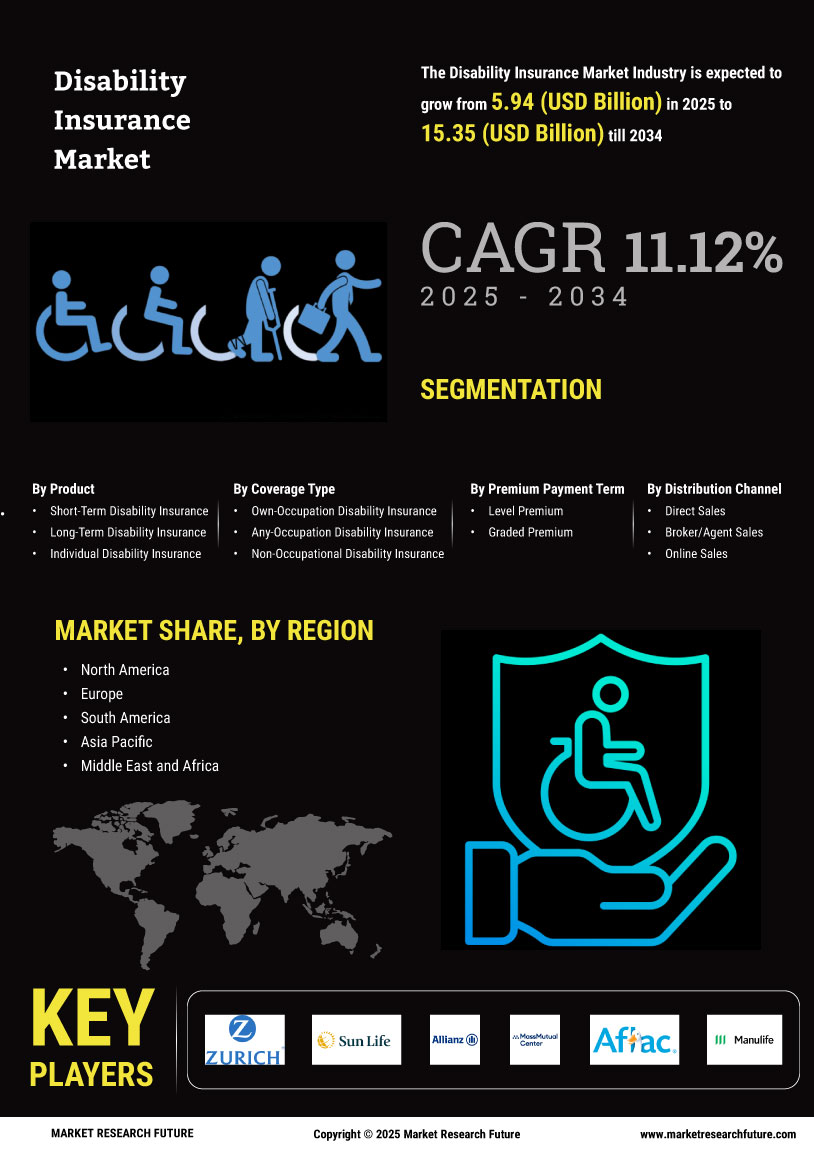

Rising Incidence of Disabilities

The increasing prevalence of disabilities due to various factors, including aging populations and chronic health conditions, appears to be a primary driver of the Disability Insurance Market. According to recent statistics, approximately 1 in 4 adults in the United States experiences some form of disability, which underscores the growing need for financial protection. This trend is not limited to one region, as similar patterns are observed in many countries, leading to a heightened demand for disability insurance products. As more individuals recognize the potential financial impact of a disability, the market for disability insurance is likely to expand, prompting insurers to innovate and tailor their offerings to meet diverse consumer needs.

Legislative Changes and Regulations

Legislative changes and evolving regulations surrounding disability rights and insurance coverage significantly influence the Disability Insurance Market. Governments are increasingly enacting laws that mandate certain levels of disability coverage, thereby compelling employers to offer disability insurance as part of employee benefits packages. For instance, the introduction of mandatory short-term disability insurance in various jurisdictions has led to a surge in policy uptake. This regulatory environment not only enhances consumer protection but also stimulates market growth as more individuals seek to secure their financial future against unforeseen disabilities. Consequently, insurers are adapting their products to comply with these regulations while also addressing the unique needs of their clientele.

Employer-Sponsored Insurance Programs

The prevalence of employer-sponsored disability insurance programs is a notable driver of the Disability Insurance Market. Many organizations recognize the importance of providing comprehensive benefits to attract and retain talent, leading to an increase in the adoption of disability insurance as a standard offering. Data indicates that nearly 60% of private sector employees have access to some form of disability insurance through their employers. This trend is likely to continue as companies strive to enhance employee well-being and productivity. Furthermore, as the workforce becomes more aware of the benefits of such coverage, the demand for employer-sponsored plans is expected to rise, thereby bolstering the overall market.

Technological Innovations in Insurance

Technological advancements are reshaping the Disability Insurance Market by streamlining underwriting processes and enhancing customer engagement. Insurers are increasingly leveraging data analytics and artificial intelligence to assess risk more accurately and offer personalized insurance solutions. This shift not only improves operational efficiency but also allows for more competitive pricing structures. As technology continues to evolve, it is anticipated that the market will witness a surge in innovative products tailored to meet the specific needs of consumers. The integration of digital platforms for policy management and claims processing further enhances the customer experience, potentially leading to increased policy adoption.

Growing Awareness of Financial Security

The rising awareness of the importance of financial security in the face of potential disabilities is a significant driver of the Disability Insurance Market. As individuals become more educated about the risks associated with disabilities, there is a growing recognition of the need for adequate insurance coverage. Surveys indicate that a substantial percentage of the population is now prioritizing financial planning, including disability insurance, as part of their overall financial strategy. This shift in mindset is likely to result in increased demand for disability insurance products, as consumers seek to safeguard their income and maintain their standard of living in the event of a disability. Insurers are responding by developing more accessible and flexible policy options to cater to this evolving consumer sentiment.