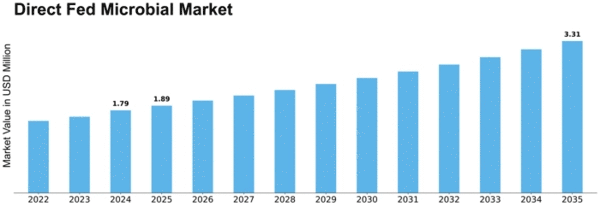

Direct Fed Microbial Size

Direct Fed Microbial Market Growth Projections and Opportunities

Direct Fed Microbials (DFM) Market development and evolution are affected by several reasons. These dynamics are driven by the growing knowledge of beneficial microbes' importance in animal health and performance. Direct Fed Microbials, live microorganisms or their components, are added to animal feed to balance gut microbiomes. This improves animal digestion, nutritional absorption, and health.

Awareness of the downsides of conventional cattle raising systems drives the DFM industry. Alternative methods are becoming more popular as antibiotic resistance and food residues raise worries about animal husbandry. Direct Fed Microbials enhance animal digestive health without antibiotics in a sustainable and natural way.

Changing customer tastes and rising demand for sustainable and compassionate animal products affect DFM market dynamics. As consumers become more aware of food quality and provenance, they are choosing goods from animals bred with less antibiotics. The quest for food supply chain transparency drives the use of DFMs as an eco-friendly animal feeding solution.

Regulatory environments also shape DFM market dynamics. Alternatives to antibiotics in animal feed are increasingly valued by governments and regulators. Thus, regulatory frameworks that promote DFM usage while assuring product safety and effectiveness are becoming more important. This changing regulatory landscape fosters DFM development and implementation.

DFM market development is driven by microbiological research and technological advances. DFM formulations are constantly refined to address individual species' difficulties as scientists learn more about animal gut microbial communities. Precision and customisation meet livestock producers' different demands, growing the DFM business.

Market dynamics are also affected by geography and cattle husbandry techniques. Intensive livestock husbandry regions may need more DFMs to handle congested and constrained environments. However, vast agricultural zones may prioritize DFMs that improve natural forage use and free-range animal health.

Global commerce affects ingredient sourcing, product distribution, and knowledge and technology exchange in the DFM sector. DFM feed additives are widely available and used since the global agriculture economy is integrated and promotes import and export. International alliances and partnerships boost knowledge transfer and DFM market innovation.

In conclusion, the Direct Fed Microbials market reflects a larger movement in animal husbandry toward sustainable and holistic livestock nutrition. As the business faces antibiotic resistance, consumer transparency, and environmental concerns, DFMs become a vital option for animal health and livestock production system sustainability. As stakeholders realize the many advantages of DFMs in current animal feeding practises, the market will rise.

Leave a Comment